What first-time home buyer scheme is right for me?

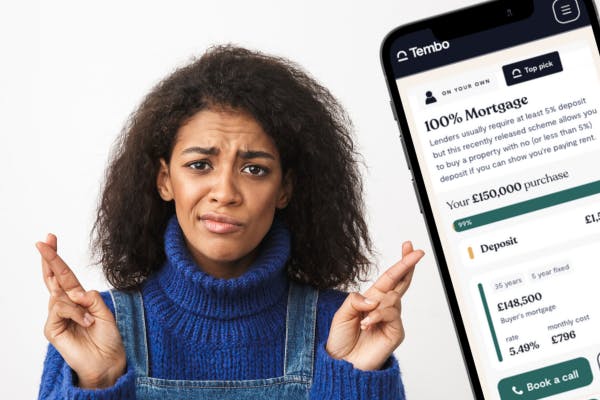

The average UK house price stands at £264,900, meaning first-time buyers will need to save almost £26,500 to put down a 10% deposit on a home. London buyers face an even greater challenge, with the average house price in the capital reaching an eye-watering £535,700. Saving so much money can be hard to do, particularly if you’re renting or buying a home solo. Thankfully, there are a number of first-time buyer schemes designed to help you overcome the most common affordability obstacles and buy a place of your own. So which one is right for you?

Each scheme listed below has specific criteria that applicants need to meet. Schemes targeted at customers with smaller deposits can have higher interest rates than standard products. In order to understand how each scheme meets your specific needs, speak to a broker.

What is a first-time buyer scheme?

A first-time buyer scheme is a scheme or mortgage product that helps new buyers overcome common affordability issues to get on the property ladder. There are lots of first-time buyer schemes to choose from and they come in different forms. These include low-deposit schemes, buying a home for less than its market value, buying a portion of a home and paying rent on the rest, equity loan schemes, family-supported options, or schemes that help you boost your deposit or your borrowing potential.

Learn more: Mortgage tips for first-time buyers

You might also like: Best mortgages for first-time buyers

How does a first-time buyer scheme work?

Different first-time home buyer schemes work in different ways. Some first-time buyer schemes, such as shared ownership and First Homes help you get on the property ladder by reducing the amount of deposit you need. Others, such as the Lifetime ISA, help you boost your deposit through a 25% bonus from the government. Others help you increase your affordability by allowing you to borrow more for a mortgage, or use family support to increase your borrowing power or increase your down payment.

Find out more about how a parent can help you get a mortgage or buy a house here

You might also like: Alternative ways to buy a house

Now, let’s take a look at each first-time buyer scheme in more detail:

Top 10 first-time home buyer schemes

1. Lifetime ISA

A Lifetime ISA is a tax-efficient savings account where you can save up to £4,000 a year towards your first home, and the government will boost your savings by 25% for free (up to £1,000 each tax year). Max out your account five years in a row and you’ll get a £5,000 bonus from the government, bringing your total LISA savings to £25,000.

You could have an even bigger deposit if you choose a LISA with a competitive interest rate, such as the Tembo Cash Lifetime ISA. With our market-leading 4.1% AER interest rate (variable), you could get hundreds more in your pocket in interest versus the next best rate on the market*.

It’s up to you whether you max out your LISA at the start of the tax year or make smaller contributions throughout the year. You can maximise the amount of interest you earn by making your deposits sooner rather than later, but don’t overstretch yourself! If you need to dip into your LISA before the age of 60 to pay for something other than your first home, you’ll be charged a 25% fee.

You could effectively double your deposit if you’re buying with another first-time buyer. Open a competitive LISA each, max out both accounts, and you’re now looking at a deposit of up to £56,000!

Be aware that Lifetime ISAs do have restrictions. As you can only use a Lifetime ISA for your first house purchase (up to a value of £450,000) or retirement, if you withdraw your savings for any other purpose you will incur a 25% government penalty, meaning you may get back less than you paid in.

Learn more: How much should I have in savings?

2. Family-supported mortgages

There are lots of ways that your family could help you buy a place of your own sooner. These first-time home buyer schemes are often called guarantor mortgages because your parent is providing some kind of support which provides collateral or reassurance to your mortgage lender that you can afford the mortgage.

If they have cash savings, your parent could gift these to you as part of or all of your deposit for your house. If they want their savings back at one point, they could do this using a Savings as Security mortgage (also known as a family guarantor or springboard mortgage). They’ll deposit 10% of the full property value into a special savings account held by your mortgage lender for a fixed period, normally 5 years. After that point, as long as you make your mortgage payments each month, they’ll get their savings back plus any accrued interest. Keep in mind though that your loved one will not get their funds back if you do not keep up with your mortgage payments.

If your parents own a home, they could also unlock money from their property to top up your deposit through a Deposit Boost. This is a way for them to contribute to your house purchase without needing money in the bank, as the money is released through a small mortgage. If they want something back in return, they could use a Deposit Loan - that way, they’ll benefit by owning a percentage of your property in return for money towards your deposit.

If your parents don’t have money to give to you, don’t worry. There are other ways they can help you get on the ladder sooner. For example, they could be added to your mortgage as a guarantor through an Income Boost mortgage. Part of or all of their income will be added to yours when calculating what you could borrow for a mortgage. With a bigger combined income, you can increase your borrowing potential, potentially helping you afford to get on the ladder sooner or buy a bigger property.

It’s important to know that by agreeing to be your Income Booster, your loved one will become liable to pay your mortgage debt if you (the borrower) fail to make your mortgage payments. This is because they are taking on the role of your guarantor.

3. Mortgage guarantee scheme

It can be hard to get a mortgage with a small deposit, especially if you don’t have a high salary or a family member who’ll act as your guarantor. Thankfully, there are plenty of low-deposit first-time buyer schemes out there, including the government’s mortgage guarantee scheme. Soon to be renamed by the new Labour government as “Freedom to Buy”, this home-buying scheme lets you purchase a property with just a 5% deposit.

It works by the government guaranteeing a percentage of the loan to encourage lenders to let buyers borrow 95% of the property’s value as a mortgage. If the buyer is unable to keep up with their mortgage payments, the government’s guarantee provides the lender with some protection from financial losses. This reduces the amount of risk for the lender, making them more likely to offer you a higher loan-to-value (LTV) mortgage.

Be aware that this scheme cannot be used to purchase new builds, and the property you purchase using the scheme cannot be more than £600,000.

The mortgage guarantee scheme isn’t the only 5% deposit scheme out there. Now, 95% LTV mortgages are widely available - in fact, there’s more 5% deposit mortgages available now than there has been in the last two years.

Read more: What are 95% mortgages & can I get one?

Discover what first-time home buyer schemes you’re eligible for

Create a free personalised recommendation on our website in 10 minutes to discover all the ways you could get on the ladder and your maximum buying budget.

4. Shared ownership

If you’re struggling to save a deposit or get a mortgage big enough for the home you want, shared ownership could be the answer. Instead of buying a property with a traditional 10% deposit and 90% mortgage, you’ll buy a portion of a home and pay rent on the rest. This can be more affordable than traditional ownership, as your deposit and mortgage won’t need to cover the full property price. To begin with, you’ll usually purchase between 25% and 75% of the property’s value, but some shared ownership schemes let you buy as little as 10%.

Let’s imagine you’d like to buy a £300,000 home. Instead of saving a £30,000 deposit and taking out a £170,000 mortgage, you could purchase a 50% share through a shared ownership scheme. You’d need a deposit of £15,000 and a mortgage of £135,000 to cover the remainder of your share.

The other 50% will be owned by a housing association or landlord, who’ll charge you rent for living in their share of the property. You can ‘staircase’ your way to full ownership by purchasing more shares over time.

It’s important to know that with Shared Ownership, you might be subject to additional fees alongside your mortgage payments, such as ground rent and service charges.

Looking to buy a new build? You may be well suited to Deposit Unlock…

5. Deposit Unlock

As if getting a mortgage with a small deposit wasn’t hard enough, it can be even harder if you’re buying a new build. Newly built homes often depreciate in value during the first few years, so lenders usually require a deposit of 15% or 20% to reduce the risk. Schemes like Deposit Unlock are designed to give lenders the confidence to approve 95% mortgages for purchasing a new build. It does this by insuring a percentage of your mortgage and giving lenders financial protection.

There are just 31 house builders offering homes through the Deposit Unlock scheme, so you may need to do plenty of research to find the right property. Plus, only three lenders are currently participating in the scheme, so it’s a good idea to work with a mortgage broker to find the most suitable lender and mortgage for you.

However, there are some drawbacks with this scheme, namely that only a limited number of lenders. This might mean you miss out on better mortgage deals and interest rates from other lenders by using this scheme. If you’d struggle to buy a home without a 5% deposit, this might not be a concern for you, but it’s worth looking into other options before making the commitment.

You cannot buy a home that requires a mortgage larger than £750,000 through Deposit Unlock either, which might be limiting for buyers in more expensive areas like London or the South West.

Take a look at our new build vs old house guide to learn more

6. Enhanced borrowing schemes

Some borrowers will be able to borrow more than the standard 4-4.5x income for a mortgage. These enhanced borrowing schemes allow eligible buyers to borrow up to 5-6 times their household income. To qualify, you have to work in a professional field, like a doctor, solicitor or accountant, or earn a high salary (at least £37,000 as a solo applicant, or £55,000 or more as a couple).

Find the first-time buyer scheme for you

We’ve helped hundreds of first-time buyers discover how they could boost their affordability. Discover what you’re eligible for in 10 minutes by creating a free, personalised mortgage recommendation.

7. Rent to Buy

The Rent to Buy scheme lets you rent a new build home at a discount (usually around 20%), making it easier to save a deposit and buy a home of your own. The rules vary depending on where you live in the UK. In England (excludes London) you can rent the property from anywhere between 6 months to 5 years through a registered Rent to Buy landlord or housing association. During that time, you’ll be given the option to buy the property or a portion of it through a shared ownership scheme. If you haven’t bought the property by the end of your agreed tenancy, you’ll need to move out.

Keep in mind that even if you are eligible for this scheme, it’s not guaranteed you will be accepted, as this is subject to landlord agreement.

London has a similar scheme called London Living Rent, which lets you rent a property at a discount while you save a deposit. The amount of rent you’ll pay will depend on the size of the property and where you live, but the average monthly rent for a 2-bed London Living Rent home is around £1,240 a month in 2024/2025 - around two-thirds less than the average market rent in October 2023 (£1,877).

To be eligible for London Living Rent, you must have a maximum household income of £60,000 and be unable to buy a home (including through shared ownership) in your area.

The scheme works slightly differently in Wales. With the Welsh Rent to Own scheme, you can rent a property for up to five years and you’ll have the option to buy it after two. If you’d like to buy it, 25% of the rent you’ve already paid will be refunded. If the property has increased in value since you moved in, you’ll also receive 50% of the increase. You can then put the partial rent refund and increase in value towards your deposit.

Northern Ireland’s scheme is also called Rent to Own. A non-profit company called Co-Ownership will buy a property and rent it to you for market rent for up to three years. At the start of the tenancy, you’ll pay a tenancy deposit (equal to one month’s rent) plus a £2,500 down payment.

You’ll have the option to buy it after living there for a year. If you do decide to buy it, your down payment will be refunded and you’ll also get a £20 refund for every £100 you paid in rent.

8. First Homes

With the First Homes scheme, you could get a discount of 30% or more on a new build property. Not only will you be able to put down a smaller deposit, you’ll also need a smaller mortgage, meaning your repayments will be lower.

The scheme’s only available in England and you’ll need a household income of no more than £80,000 a year (£90,000 in London). You can use the scheme to purchase a home worth £250,000 or less (£420,000 or less in London) once the discount has been applied.

Key workers are prioritised, so if you’re a doctor, nurse, teacher, delivery driver, supermarket worker or member of the Armed Forces, this could be the scheme for you. Technically, you can still be eligible if you’re a first-time buyer in a different profession, but you may find it harder to get your hands on the right property if there are lots of key workers in your area.

There are some drawbacks to this scheme to be aware of. Firstly, it can be difficult to find eligible properties, as there’s no one website to view all the eligible properties together. So you will have to do a fair bit of research to find one that is eligible for the scheme.

The other thing to be aware of is that when you come to sell the property onto the next owner, you’ll need to pass on the 30-50% discount over to them. This means you may not make as much profit from the home sale as you hoped to.

Read our full guide on the First Homes scheme here

9. Forces Help to Buy

If you’re in the military, the Armed Forces Help to Buy scheme could give you an interest-free loan of up to 50% of your annual salary (or a maximum of £25,000) to put towards a home. You can use the government loan as a house deposit, to pay solicitor and estate agent fees, or in some cases to renovate a property.

The most you can borrow is £25,000 and the loan given to you will be capped at 50% of your salary. To be eligible, you’ll need to have more than 6 months’ service history.

Mortgage lenders will take the interest-free loan into account when assessing how much to lend you. If the lender has concerns about your ability to repay your mortgage alongside the loan repayments to the government, you may be offered a smaller mortgage or rejected completely.

10. Right to Buy

The Right to Buy scheme is a government initiative that allows eligible council house and housing association tenants to buy their home for a discounted price (up to £102,400, or £136,400 in London). It was introduced to promote home ownership that benefits tenants who have been living in their council home for longer - the longer you’ve been there, the bigger the discount you’ll be eligible for. You can find out more about the Right to Buy scheme here.

On average, our customers boost their budget by £88,000!

We’ve helped hundreds of first-time buyers discover how they could boost their affordability and get on the property ladder. Create a free Tembo plan today for your very own personalised mortgage recommendation.

Learn more

*Based on saving £1,000 at the beginning of each year for 5-years. Calculations show that after 5-years (in the 61st month) Tembo customers saving at 4.10% would have £584.01 on average more than saving with the next best competitor on the market.