Olivia, you’ve got 7 options to buy that home worth

£300,000

We search over 100 lenders & 25 schemes to find you the best deal

That's how we increase budgets by an average £88,000 versus “standard” mortgage calculators.

Get startedThe mortgage you need, no matter your situation

Buying, remortgaging, moving. It’s harder than ever. But we’re making home happen, against the odds. It’s why we’ve been voted the UK’s Best Mortgage Broker four years in a row.

Single income first-time buyer

Buying with complex income

First-time buyer in London

Using income to boost affordability

Remortgaging to gift a deposit

Acting as a silent guarantor

The ultimate mortgage experience

Rated 5 on Trustpilot and Google by over 2,000 people

We’ll find you the best deal

From 20,000+ products and 100+ lenders

Same day appointments

Book an instant appointment 7-days a week

A dedicated case manager & advisor

By your side from hello to getting your keys

Instant property valuations

Free home reports with 120+ data points

Advice from UK’s Best Mortgage Broker

As voted by our customers four years running

A lightning quick service

Average time to mortgage offer is just 10 days

Protection & insurance advice

The cover you need to protect you & yours

Hassle-free moving service

Easy utilities, moving & services set-up

Access to our panel of conveyancers

Tried & tested paid legal guidance from our experts

Our fees are simple

Plus, you'll only pay when you have a mortgage offer from a lender. Find out more here.

Free

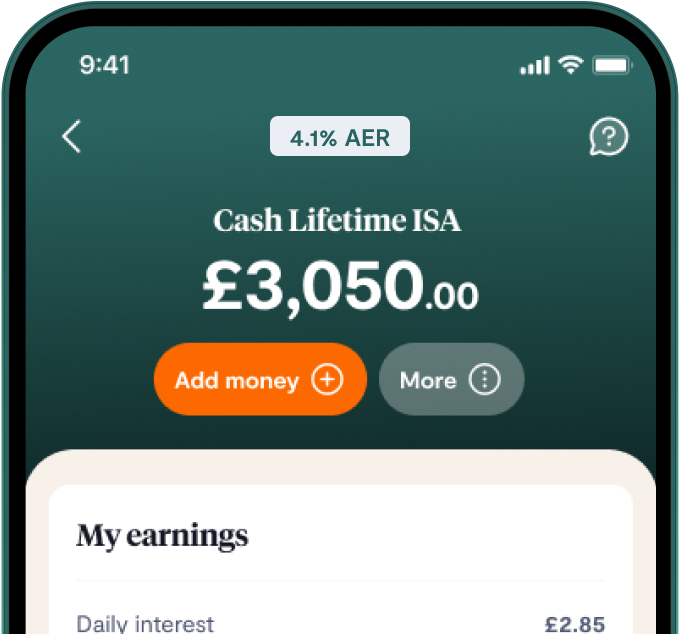

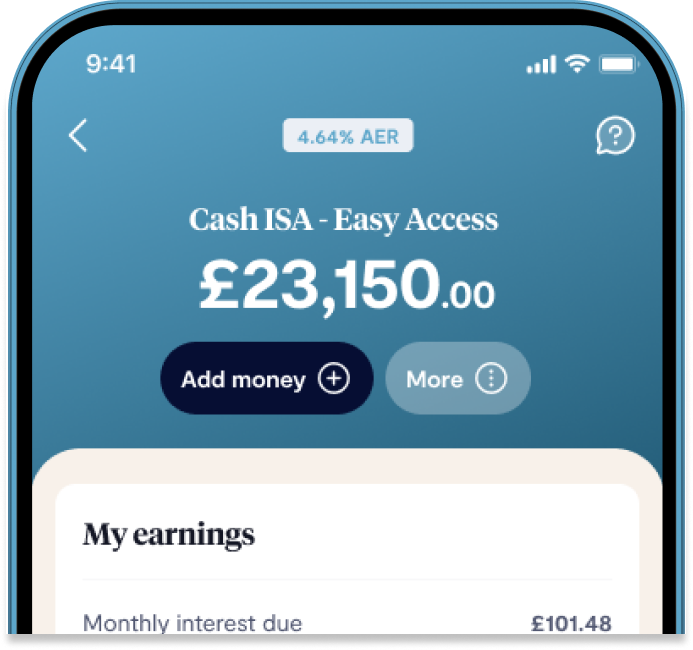

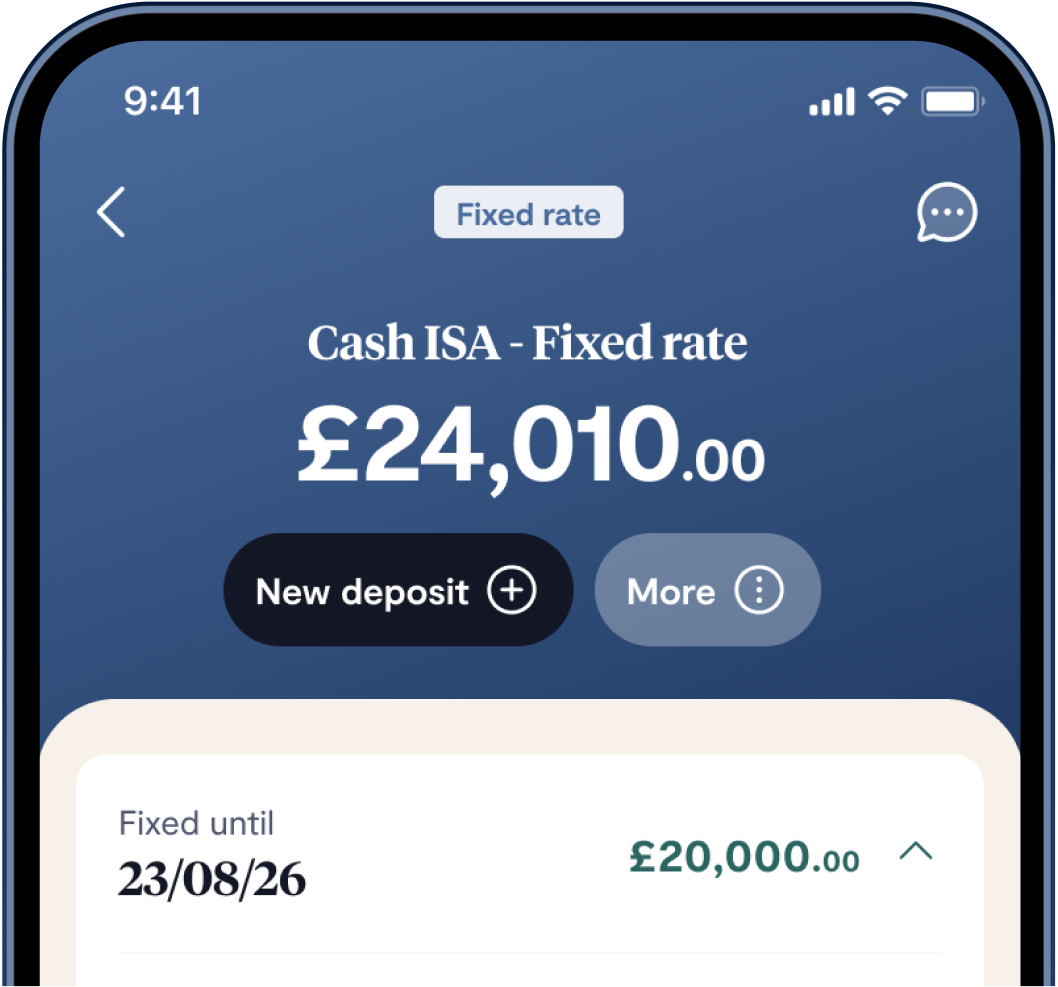

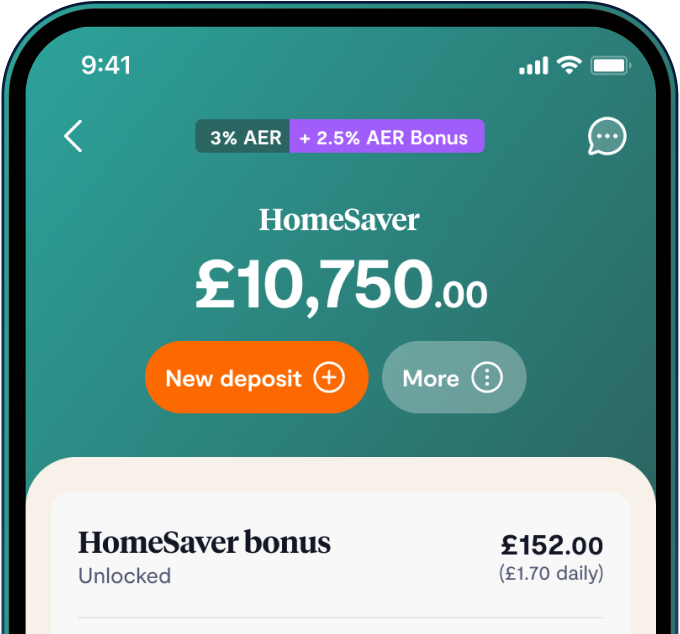

Tembo Savers

Our savings customers go fee-free. T&Cs apply.

£499

Standard

Buying or remortgaging with no affordability hurdles or complexity.

£749

Complex

If you need extra support due to affordability, credit or complex needs.

Access our team of experts, round the clock

Whether you're trying to buy your first home or save an emergency fund, our award-winning team are here to help 7-days a week.