Remortgage with the UK's Best Mortgage Broker

Whether you want to release equity, borrow more, access better remortgage rates or give your child a helping hand, Tembo can help you to remortgage. Create a free remortgage plan to discover how much you could borrow, and the best remortgage deals for you.

Voted the UK's Best Mortgage Broker

Open 7-days a week & until 8pm Mon-Thur

Average 8 days to mortgage offer

Why Tembo?

We help buyers, movers and homeowners discover how they could boost their affordability in 3 simple steps. It’s why we’re the UK’s Best Mortgage Broker.

Get fee-free remortgages. For life

Any Tembo customer that has taken out a mortgage through us once, gets our service fee-free every time they remortgage. For ever and ever. So you get the same five-star service you experienced the first time around, at no additional cost.

Get a mortgageSave money with our free rate checking service

We'll apply for your remortgage 6-months before the end of your current deal. If interest rates go down in that time, contact us and we'll cancel the old application and submit a new one at no extra charge. If rates go up, then your interest rate will be safely locked in.

Why remortgage?

There can be lots of reasons you might want to remortgage. Whatever your reason, our expert advisors will be by your side.

Your current mortgage deal is ending

If your fixed rate mortgage is coming to an end, then remortgaging onto a new deal is essential. Otherwise you risk paying the lender's standard variable rate. Plus, we can see if there's a better deal available.

You want to move to a new deal

If you want to move over to a new mortgage deal, it's worth scouting out what options are open to you. Our smart tech will find the best deals for you from over 100 lenders.

You want a new deal with the same lender

Looking to use a product transfer to switch to a new mortgage deal with the same lender? Discover what deals from your current mortgage lender you could be eligible for, and if it's the better choice than changing providers.

You need to reduce monthly repayments

Struggling to afford your monthly repayments? We specialise in finding a way for our customers, to help reduce monthly repayments or increase borrowing so they can access better remortgage deals.

You want to release equity or borrow more

If you want to release some of the equity you've built up in your property, remortgaging is the right time to do it. We can help you find the best remortgage deals from a panel of over 100 lenders.

You're staircasing with Shared Ownership

Are you looking to remortgage a shared ownership property? You're in the right place! We could help you find the best deal to staircase up to 100% ownership over time.

You're buying your ex out

If you're going through a separation or divorce and want to stay in the home you love, you'll need to afford the mortgage on your own. We're experienced at finding ways to do this.

You're paying back your Help to Buy loan

Looking to remortgage to pay back your Help to Buy loan? We can help you find the best way to release equity from your home, so you could pay back your equity loan.

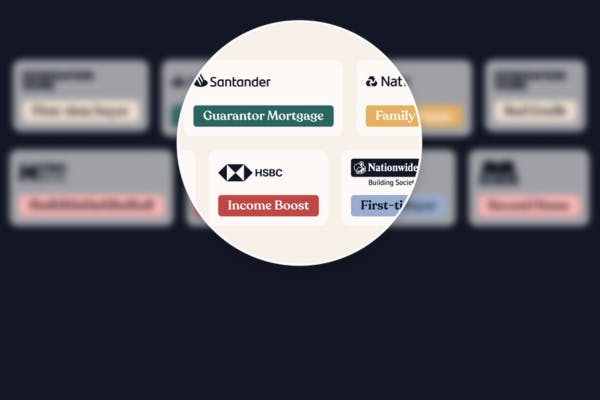

Find the best available rates from 100+ lenders

When the time comes to remortgage, it can be tempting to stay with your existing lender. But this could cost you significantly in the long-run.

We'll assess what deals you're eligible for from over 100 lenders and 20,000 products to ensure you get the best rate and deal. Compare live rates from across the market today, or create a Tembo plan for a personalised recommendation

The interest rates shown are an indication only and are not guaranteed. Current rates may have changed by the time you come to apply.