How to save for a house

Are your housemates driving you crazy? Do you lose entire evenings watching home transformation videos on TikTok? Do you dream of having your own space?

If this is you, you might have started thinking about owning a home of your own some day in the future. But you might also be wondering how to save for a house in the first place. How long does it take to save for a house? And what’s the best way to save? Look no further because we’ve answered your top questions below.

In this guide

Get rewarded for buying your first home with a Tembonus

Buying a home can feel like a maze of paperwork and decisions. With HomeSaver, there'll be a reward waiting for you at the finish line, whether you're buying your first place, your next, or remortgaging.

How much does it cost to buy a house?

The cost of buying a house in the UK varies wildly depending on where you want to buy. On average first-time buyers need a house deposit of £59,000 (£132,685 in London) to get on the property ladder. This makes putting money aside to save for a house critical, as well as getting help from family members if possible. But, the amount you need to put aside for a deposit will also depend on the cost of the property you're buying. The average price of a home in the UK is £267,100 but this varies from location to location. Popular living locations such as cities tend to be more expensive than out-of-the-way rural towns. For example, the average house price in London is £537,400, while in Newcastle it’s £155,400, and in Manchester it's £227,200. So for a 10% house deposit, you'd need on average £53,700, £15,500, or £22,700 respectively - this is why how much you need to save can vary!

You also have to take into account the type of property to determine cost. Detached houses tend to be more expensive than semi-detached properties or terrace houses. While flats and maisonettes can be even more affordable.

When you get a Lifetime ISA with Tembo, we show you your time to buy, based not only on what you've got saved but also where you want to buy and the size of property. So you can set a realistic target and see how long it will take to get there.

Read more: What are the different types of houses in the UK and which is right for you?

How much should I save for a house?

If you’d like to buy a house, it can be a good idea to aim to save a house deposit of 10% of the overall property value. So, if you’d like to buy a £300,000 property, you’ll need to save £30,000. However, saving a deposit of 20% or more can give you access to much better interest rates and make your mortgage payments cheaper. Though of course, saving this much money is easier said than done.

Thankfully, it’s sometimes possible to buy a house with a 5% deposit or less, including mortgages for high earners, professionals and key workers, as well as Skipton's Track Record mortgage and guarantor schemes. We’ve created a handy tool to find out if you’re eligible for one of our low-deposit mortgages. It takes no time at all to add your details, and there’s no credit check involved. All you have to do is create a free plan, and you’ll get a personalised recommendation at the end of it.

At what age should I start saving for a house?

Saving a deposit can take a very long time, so the sooner you start saving, the better. On average, first-time buyers start saving for a deposit at 24 but don’t get on the property ladder until they are 32. But if you start later than this, don’t worry! Many people don’t think about saving for a house until much later.

When you do start saving, it’s a good idea to use a Lifetime ISA (LISA) to put money aside, as you can benefit from an additional 25% boost to your savings from the government each tax year, up to £4,000

If you’d like to buy a house as soon as possible, you might be tempted to give up all non-essential spending in pursuit of your goal. But try to maintain some balance. It’s important to live your life in the present, even if you have big dreams for the future. Otherwise, you might one day regret sacrificing travel, nights out and time with friends — especially if you buy your home and have nobody to invite around for dinner!

Read more: Lifetime ISA vs Help to Buy ISA: What's the difference?

You might also like: Can I keep my Lifetime ISA if I move abroad or go travelling?

Start building your deposit today

Start building your house fund today by opening a Tembo Cash Lifetime ISA. Get a free 25% bonus on top of your savings, up to £1,000 and earn Tembo's market-leading rate of 4.1% AER (variable) on your savings - that's hundreds more in interest towards your house fund vs saving with the closest competitor!

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

How long does it take to save for a house?

On average, it takes first-time buyers almost 10 years to save for a deposit on their first home. This is due to the fact that the average property price for first-time buyers’ is £281,900. While this may seem daunting, it’s worth keeping in mind that a lot of first-time buyers don’t buy alone. Whether it’s with your partner, friend or sibling, buying with another person or a group can help you get on the ladder sooner by boosting your buying budget and mortgage affordability.

You can find out more about Joint Mortgages here.

Your family and loved ones might also be able to help. In fact, over half (56%) of first time buyers are reliant on family support to get their first home. While not every family has lump sums of cash sitting around, there are ways your parents or loved ones can help you get your first mortgage without having millions in the bank.

At Tembo, we advise on a range of guarantor mortgage and family-assisted mortgage schemes that allow families to help each other get on the ladder. If you’d like to find out what options could work for you and your family, all you have to do is create a plan with us today. It’s free, takes only 10 minutes to complete and there’s no credit check involved.

Feeling nervous about talking to your relatives about inheritance or the ways they could support you getting a home? We understand that money is a tricky subject for many families, so we’ve put together this guide to help you broach the subject.

How to begin saving for a house

1. Set a budget

First thing’s first, to begin saving for a house, you’ll want to set a budget. Budgeting might sound boring, but you don’t have to go down the Excel spreadsheet route — unless you want to. If you’re the creative type, you could treat yourself to a new bullet journal and manage your budget that way. If you’d rather have everything on your phone, you could plan your income and outgoings on your Notes app. There are also plenty of budgeting apps out there, such as Yolt and Emma.

To set a budget, make a note of your:

- Monthly income - if you have any side hustles or you get benefit income or child support, don’t forget to include those.

- Essential monthly outgoings - how much do you spend on rent, bills, food, travel, student loan payments, etc. each month?

- Non-essential monthly outgoings - how much do you spend on holidays, socialising, clothes, and hobbies etc.?

The next step is to look for ways to reduce your spending in as many categories as possible.

You don't have to give up everything you love!

In fact, looking for ways to reduce your essential monthly outgoings can sometimes be more effective than slashing the fun stuff.

Use our Take Home Pay Calculator

Have a play around with our Take Home Pay Calculator to see how much you have left each month, and what you could put away for a house deposit.

2. Reduce essential expenses

Next, go through your essential expenses and see what you can reduce.

- Are you able to reduce your rent? Moving in with family members tends to be the most effective option, although it’s not possible for everyone. With energy bills on the rise, they might even appreciate having someone to share the bills with.

- The more housemates the merrier. If you currently have just one or two housemates, moving into a shared house with more people could reduce your rent and bills. Saying that, if you’re happy where you are, this might not be a sacrifice worth making.

- Switching broadband provider. Broadband companies tend to offer the best deals to new customers, so if you’ve been with yours for a while, you may get a better deal elsewhere.

- A healthier and cheaper commute. Do you live within walking or cycling distance of the office? You could save hundreds of pounds a year by ditching your car or public transport. If this isn’t possible, could you lift-share with a friend? Or maybe you could ask your boss if you can work from home more often. Before you have a chat with them, remember that one or two WFH days a week won’t save you much money if you still have to buy a weekly bus/train/tube pass anyway.

3. Reduce non-essential expenses

Now for the bit that you’re dreading. It’s time to cut some of the fun stuff. Maybe you could go on half as many nights out, set a strict monthly clothing budget, and go on a weekend city break in your own country instead of a two-week beach holiday abroad.

If travel is your raison d'etre, you could make more cuts from other areas of your budget. It’s good to be strict with yourself, but not if it makes you unhappy. Good budgeting is all about working out what’s most important to you and what you can do without.

4. Look for ways to boost your income

If you can increase the amount of money you bring in each month, this can help you save up for a house quicker.

- Have you ever asked for a pay rise? Negotiating your salary can be scary — especially if it’s your first time. But think of it as a rite of passage. Once you’ve asked once, you’ll find it easier to stand up for yourself in future too. If getting a pay rise isn’t possible, can you do overtime? Take on a few extra hours a week and put that extra pay straight into your savings account.

- Can you take on any side hustles? If you speak a second language, can play the guitar, or you’re amazing at maths, you could make money by teaching others. Another option is to sell your skills as a service. Writing, designing, coding and social media management are perfect for this. You could look for jobs on Upwork and Fiverr, but building an online portfolio and finding clients through TikTok and LinkedIn may be more profitable.

Once you’ve set your budget and worked out where you can save some cash each month, the next step is to work out how you’re going to save your money.

What’s the best way to save for a house?

The best way to save for a house is the one that you find easiest. This could be setting up a standing order each month after you get paid that automatically puts money into a savings account before you have a chance to spend it. You could do the reverse, and transfer money to another account each month to live off, so you can keep an eye on spending and know if you've reached your monthly limit. However you do it, we’d recommend making the most of your savings with the help of interest and government bonuses.

Here are a few accounts that allow you to do just that:

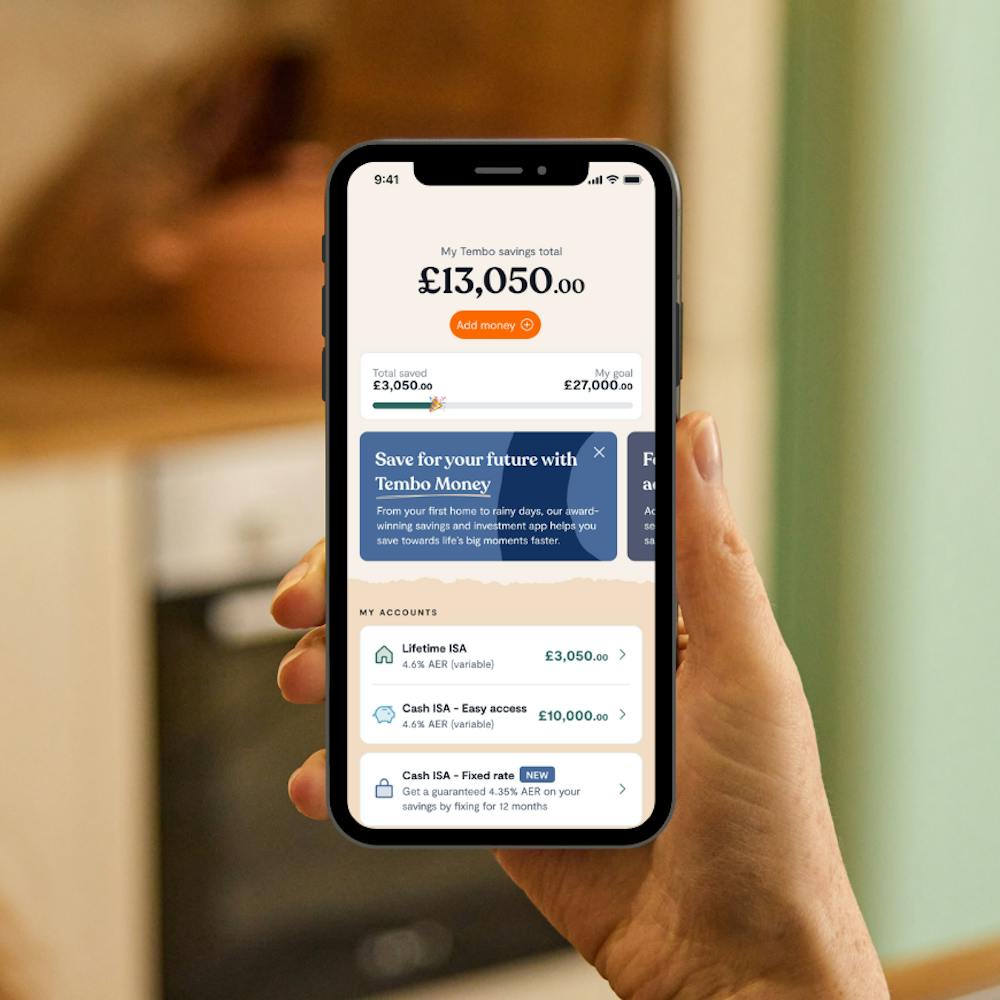

Lifetime ISA

If you’re going to the trouble of saving for a house deposit, you may as well get some free money from the government as a reward! This is where the Lifetime ISA (LISA) can come in handy.

You can save up to £4,000 a year into a LISA and the government will boost your savings by 25%. So if you max out the account for 5 years, for example, you’ll get a sweet £5,000 top-up from the government. The maximum bonus is £33,000, but hopefully you won’t have it for that long!

There are two main types of LISA: a Cash LISA and a Stocks & Shares LISA. A stocks & shares LISA can lead to greater returns in the long run, but your money will be at risk and there’s no guarantee you’ll get back what you put in. If you want to buy sooner or feel uncertain about investing in the stock market, then a cash LISA is the best option.

Frustratingly, you can only use the government bonus towards a house worth £450,000 or less. So if you’re hoping to buy a pricey flat in central London or a large forever home in a popular leafy suburb, it might be unsuitable.

Also, if you need to access your LISA savings for anything other than your house deposit or retirement, you’ll be hit by a 25% charge on the amount you withdraw. So avoid putting money in your LISA that you may need for short-term expenses or emergencies.

Easy access savings accounts

If you’re maxing out your Lifetime ISA (or it’s unsuitable for the type of house you’d like to buy), open an easy access savings account with a generous interest rate. Interest on savings has been low over the last few years, but in 2022 they started to rise again. Some easy access accounts are offering as much as 5%, but they tend to be on small amounts.

As the name suggests, an easy access account will let you access your money with very little effort, meaning they’re ideal in the event of an emergency.

You might like: Best savings accounts in the UK

Notice savings accounts

Another option is to open what’s known as a ‘notice savings account’. This is a type of savings account where you can withdraw your money and spend it on whatever you want, but you need to give them notice. Notice accounts tend to have interest rates of around 2% - 3.5%. You can usually put a larger amount of money in a notice account than you can in an easy access.

Notice accounts can be ideal for first-time buyers because even if you find the perfect house for you, it can take a few months to complete the buying process — giving you plenty of time to give your bank notice and withdraw the money.

Fixed savings accounts

Fixed savings accounts such as Fixed Rate ISAs tend to offer generous rates guaranteed for a set period of time, but the downside is you can’t usually withdraw your money until the end of the term.

This can be ideal if you’re not planning on buying a house for a year or more. The longer you’re able to lock your savings away, the better the interest rate usually is. Fixed savings accounts will probably be unsuitable if you want to buy somewhere in the next few months.

Find out more: Are Fixed Rate ISAs a good idea?

Save with the market-leading ✨ Cash Lifetime ISA ✨

Save up to £4,000 each tax year and get a free 25% bonus on top of your savings, up to £1,000. Plus, with the Tembo Cash Lifetime ISA, you'll earn 4.1% AER (variable) on your savings - that's hundreds more in interest towards your house fund vs saving with the closest competitor!

What should you do if you’re struggling to save a house deposit?

With property prices rising so quickly and the cost of living on the up, you could follow all our tips above and still struggle to save a house deposit. At Tembo, it’s our mission to help home buyers boost their buying budget, helping you discover specialist schemes that can help you get on the ladder sooner. These fall roughly into two types, getting help from family or friends, or buying by yourself with help of a scheme.

Buying with family or friends

If you’re rolling your eyes right now, hear us out. We know that large cash gifts from the Bank of Mum and Dad aren’t realistic for everyone. But, there are alternative ways they could help you get your first home that don’t involve cash gifts. So if your parents want to help, but don’t want to part with a gifted deposit, here are a few alternative ways to get on the ladder with family help:

1. Family Springboard mortgage

A family springboard mortgage involves using your family member’s savings to buy a house — without taking their cash away from them forever. Instead of giving you the savings as a gift, your family member will lock their money away in a savings account held by your lender. This money will be used as a security, meaning the lender will be allowed to keep the money if you fail to pay your mortgage.

If you make your mortgage payments on time each month, your family member will get their savings back (plus interest) after an agreed period. The exact period of time will depend on the lender, but it can often vary between 3 years to 10 years.

2. Deposit Boost

A Deposit Boost involves releasing a portion of equity from a family member’s home to gift to you as a house deposit, or to add to the deposit you already have saved up. A lot of over 55s in the UK own their own home, and have accumulated healthy equity in their home as house prices have risen over the past few decades. This places many parents and grandparents in a position to use a small amount of their equity to help a younger generation get their first mortgage through a Deposit Boost. So if your Mum, Dad, or doting Aunt wants to help you buy your own place, this could be the solution to your woes. If you’d like to know more, you can read more about Deposit Boost here.

3. Income Boost

If you’re struggling to save a house deposit because you’re on a low income, you could boost your mortgage affordability with an Income Boost. An Income Boost involves adding a family member’s salary to your mortgage application to increase your borrowing potential. This type of loan is traditionally known as a joint borrower sole proprietor mortgage, (AKA. JBSP), but at Tembo we call it an Income Boost, which is much simpler. You can find out more about an Income Boost mortgage and how it’s helped other Tembo customers get on the ladder here.

Buying a house without help from family

If your loved ones aren't in a position to help you buy, there are other schemes out there that can boost your mortgage affordability without family support. Here are a few of the options that you could consider:

1. Shared Ownership

If you’re buying a house without your family’s help, shared ownership could be an option. Shared ownership involves taking out a mortgage on a percentage of a property instead of the full value, and paying rent to a housing association or developer on the rest. Over time, you’ll ‘staircase’ your way to full ownership by buying more shares of the property.

Although shared ownership can offer you an affordable leg-up onto the ladder, it can work out to be more expensive in the long run than buying a house in the traditional way. But for many, it’s a great option to get your first home and it can be a good alternative to renting.

If you’re unsure whether to continue renting, read our guide Rent vs buy: which is right for you?

2. Higher lending schemes

Some first-time buyers are eligible for higher lending schemes that allow you to borrow up to 5.5 times your income. These schemes often have stricter criteria, so it’s harder to pass the affordability checks. Normally, you cannot be self-employed, and you must earn over a certain amount to qualify, as well as have an excellent credit history. At Tembo, we have access to a number of higher lending schemes which our team of award-winning mortgage brokers can advise you on.

To see if you are eligible for one of these schemes, and what other options are available to you, create a plan on our homebuyer platform today.

3. Deposit Unlock

Deposit Unlock is a scheme that allows you to buy a new-build home with only a 5% house deposit. You can be either a first-time home buyer, or a home mover, but the new build must be from a participating builder to qualify. Our team of mortgage experts have access to all lenders that offer the Deposit Unlock scheme, so are perfectly placed to help you find the best deal.

At Tembo, we specialise in helping first-time buyers across the UK turn their homeownership dreams into a reality. Working with over 100 mortgage lenders with a range of home-buying schemes, our award-winning team can help you find the perfect way to boost your buying budget. To get started, all you have to do is create a free Tembo plan today.

We've helped thousands discover how they could buy sooner

Find out how much you could increase your buying budget by creating a Tembo recommendation for free. It takes 10 minutes to complete, and there's no credit check involved.