Are interest rates rising and what does it mean for me?

Find out what's happening with interest rates and if they are going up or down in this essential guide.

Are interest rates going up?

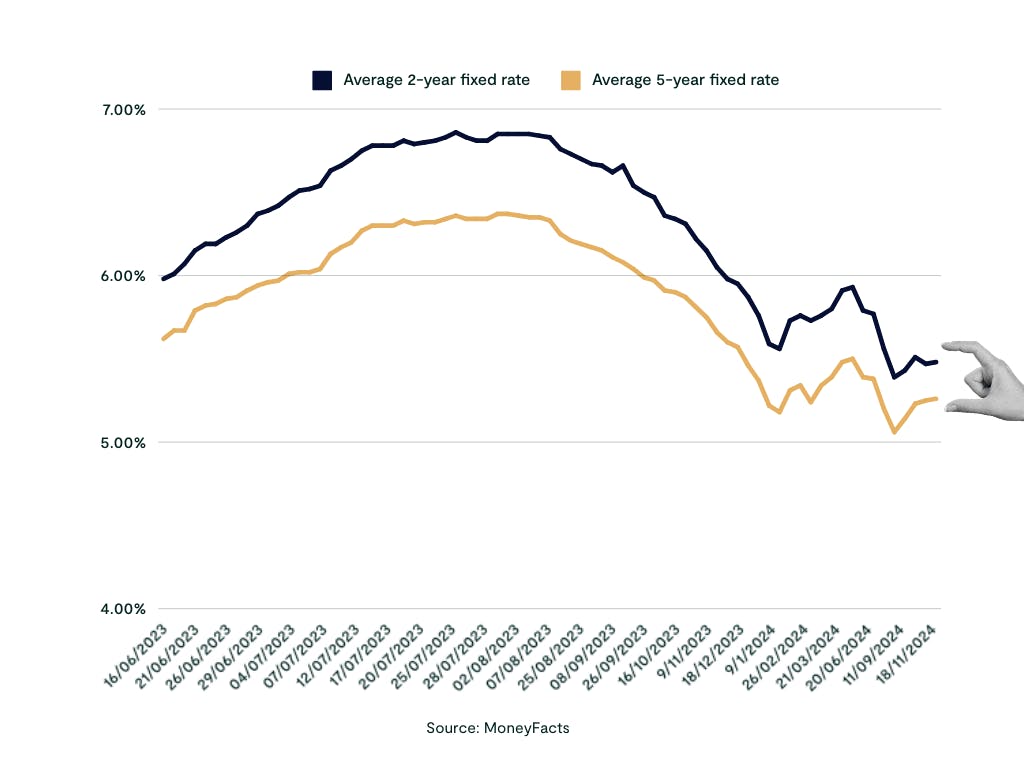

Although interest rates are currently above the typical 4-5% mark and we have seen some recent rises, there are other lenders that have been cutting deals. The average 2-year fixed rate mortgage is now 5.34%, while the average 5-year fixed rate is 5.18%, but we could see this average come down over the coming weeks following the recent inflation data. The most figure puts inflation at 2.8% - 0.2% lower than the month before and lower than the market was expecting. This could mean that the Bank of England chooses to cut the base rate when they next meet. If this happens, this should cause mortgage lenders to also reduce their own rates.

Plus, what rate you'll be offered right now is also impacted by your downpayment and eligibility. For borrowers with a 10% deposit for example, the best available rate from our panel of 100 lenders is 4.51% for a 5-year fix - significantly lower than the average rate.

*Based on 90% LTV, with a 35-year mortgage term. Interest rates are accurate as of March 2025.

Why are interest rates high?

Interest rates are higher than the typical 4-5% because the Bank of England repeatedly voted to keep the base rate high - currently it stands at 4.50%. This is to curb inflation - keeping the base rate high increases borrowing costs, making loans more expensive. This was intended to reduce our disposable income so that we all spend less on goods and services. This reduction in demand then means companies reduce prices, or at least not increase them as quickly, which in turn brings inflation down. By keeping the base rate high, the Bank of England also increases the amount it charges other banks to borrow money. Because it's more expensive for them to borrow money, banks typically increase their own interest rates as a result.

What is inflation and how does it impact mortgage interest rates?

See today's best mortgage rates

Compare the latest mortgage interest rates from across the market, or create a free Tembo recommendation for a personalised rate.

The interest rates shown are an indication only and are not guaranteed. Current rates may have changed by the time you come to apply.

Why is the base rate high?

By keeping the base rate high the Bank of England has been trying to slow down consumer activity, which means companies can’t increase their prices so quickly. So far this has been working, reducing inflation from the 11.1% peak in October 2022 to 2.8%. But inflation is remaining stubborn, so although the Bank of England voted to cut the base rate in February to 4.5%, the next cut might not come until May.

How high will interest rates go?

Despite rising slightly over the last few months, inflation has recently dropped by 0.2% - from 3.0% in January 2024 to 2.8% in February 2025. If this continues for the rest of 2025, interest rates shouldn't go up, and instead should come down gradually. But even if mortgage rates do drop over 2025, it’s likely that mortgage rates will stay higher for longer - according to the OBR, mortgage rates could go up to 4.7% by 2028, staying at that level in 2029.

How do rising interest rates impact first-time buyers?

When interest rates rise, this makes mortgages more expensive as it increases the amount of interest you pay each month alongside paying off your mortgage loan. If you're a first-time buyer, higher interest rates might mean that you have to borrow less for a mortgage in order to afford the monthly repayments or put down a larger deposit to get a lower LTV. If you're still saving towards your first home, high interest rates can be a good thing however if saving rates are also high, as you could earn more money on your savings.

If you're struggling to save for a house, don't worry. Set up a Cash Lifetime ISA with us today to benefit from our market-leading 4.1% AER (variable) interest rate, plus a free 25% bonus from the government. There are also ways to buy a home with a small deposit, as well as schemes that help you boost your deposit size.

Remember: When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

Open an account with just £10 or transfer today

Open a Lifetime ISA with Tembo today to benefit from our market-leading 4.1% interest rate, helping you save hundreds more towards your deposit over a 5-year period versus the next best competitor on the market

How do rising interest rates impact homeowners?

If you already own a home, the rising interest rates will only impact you if you are coming to the end of your current fixed rate deal and are looking to remortgage, or you are on a variable rate. The average household looking to remortgage in 2025 could see a £2,900 increase to their repayments. This is why finding the best deal possible for you is vital, as it can help mitigate the potential rise in mortgage costs.

The good news is, if you're struggling to remortgage you're in the right place. At Tembo, we're experts in helping homeowners increase their affordability so they can access lower interest rates and stay in the home they love. To find out what remortgage rates you could get, create a free Tembo recommendation, personalised to you.

Learn more about how interest rates work in our guide - What are mortgage interest rates?

Discover how you could boost your affordability

Whether you're a first time buyer trying to get on the ladder, or a homeowner struggling to remortgage. Our award-winning team and innovative smart tech will find you all the ways you can boost your affordability to buy sooner or access lower rates. Create your free, personalised Tembo recommendation to get started