Base rate holds at 4.5%, and won’t be cut until May

Today (20th March 2025), the Bank of England’s Monetary Policy Committee (MPC) voted to hold the base rate at 4.5%. This was widely expected by the market, with the committee voting 8-1 for the rate to stay at its current level. Now, the next base rate cut isn’t expected until May, with inflation expected to increase off the back of uncertainty in the global markets, the upcoming Spring Statement, supply chain disruptions and other economic factors.

Read more: What is the base rate and how does it impact interest rates?

Key takeaways

- Bank of England votes 8-1 to hold base rate at 4.5%, with the next cut not expected until May

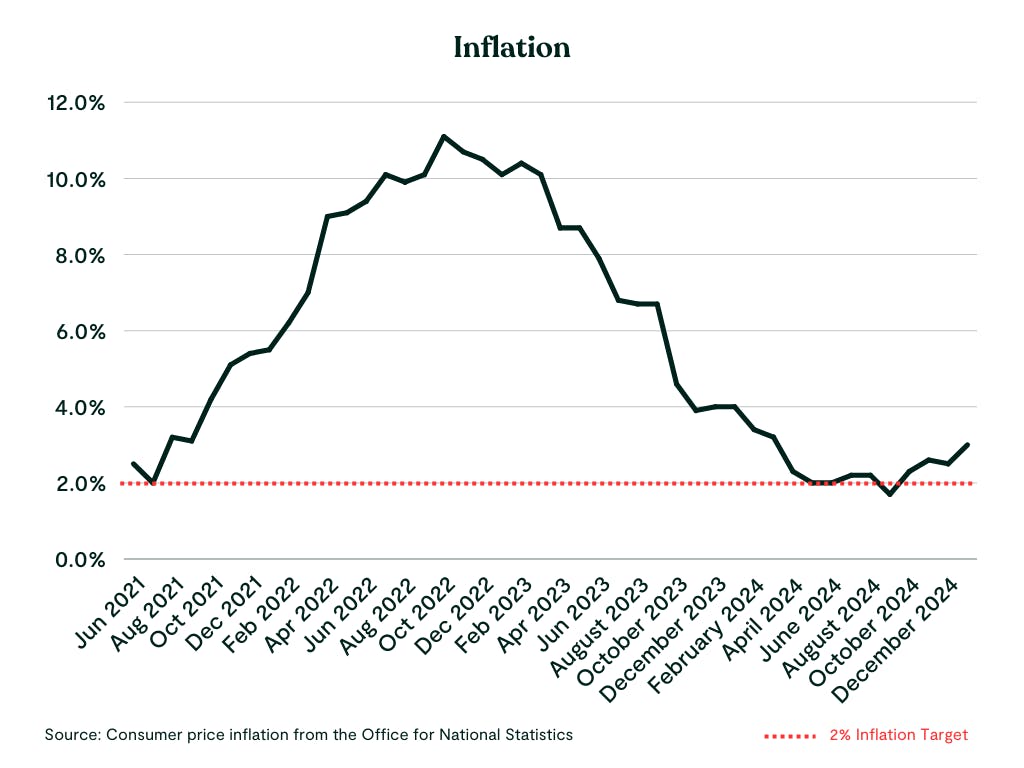

- Inflation remains above 2% target and is expected to increase to 3.7%

- Supply chain disruptions, tariff changes & other economic factors could also contribute to inflation staying high, forcing the Bank to delay cuts further.

- Mortgage rates staying high should weaker buyer demand, reducing buyer competition and keeping house price growth in check

- Holding off buying until rates come down could cost you £2,346 more

- Why the base rate staying higher is good news for savings

Inflation remains above the 2% target

Inflation rose by 3.0% in January 2025, which is an increase from 2.5% back in December. The largest contributor to this came from transport, food and non-alcoholic beverages, but core inflation, which excludes volatile items like energy, food, alcohol and tobacco also rose, from 4.2% in December to 4.6% in January.

Not only does this mean inflation is higher than expected, this is above the Bank of England’s 2% target. Up to this point, inflation has been pretty stubborn, keeping everyday expenses and the cost of borrowing high. This hasn’t been helped by climbing wage growth, which saw the fastest rise in over three years at the end of last year.

When wages rise faster than productivity, businesses face higher labour costs. To maintain profitability, they may increase prices, which pushes up inflation. This is why the Bank uses wages as a key indicator of inflation and has said that average earnings need to fall to about 2-3% per year to get inflation back to its 2% target.

Read more: What is inflation and how does it impact mortgages?

But it’s not just what’s going on in the UK

There is uncertainty worldwide politically and economically in response to off the back of what’s going on in America and other parts of the world.

Globally, Trump’s trade tariffs are causing havoc - so much so the OECD cut its global growth forecast for this year from 3.3% to 3.1% - in 2024, the global economy grew by 3.2%. If Trump’s plans to impose 25% tariffs on almost all merchandise imports from Canada and Mexico go ahead - America’s largest trading partners - this would almost halve the growth forecasts for Canada and push Mexico into a deep recession.

The UK won’t be unscathed either. It’s estimated that the total annual value of UK exports affected by the latest tariffs would be around £2.7bn. For context, the UK exported around £58bn of goods to the US in 2024 - so the share of goods hit by these new tariffs is just under 5%.

At the minute, there’s hope that the UK can get the Trump administration to agree to a free trade deal, which could mean these tariffs would be removed - but this isn’t guaranteed. If the tariffs go ahead, this could unpick progress made to reboot economic growth and tackle inflation.

The Spring Statement could hike inflation too

Inflation may also increase off the back of the Chancellor’s Spring Statement on the 26th of March - when she’ll give an update on her plans for the UK economy and an economic forecast.

No big policy announcements are expected in the Spring Statement, but spending cuts to welfare and other government departments are, as well as reorganising the civil service and scrapping quangos like NHS England.

But with the economy underperforming, rising borrowing costs and global uncertainty impacting the UK, there is growing speculation whether Rachel Reeves will break her self-imposed rules on borrowing. If she doesn’t, tax rises could be on the cards to give the government more headroom - although the Chancellor has committed to not raise taxes any further after her Autumn Budget.

Ultimately, any of the measures announced in the Spring Statement which could increase costs for businesses or consumers could contribute to inflation rising or staying higher for longer.

The UK economy needs a boost

Despite growth being put high on the UK government’s agenda, the latest figures showed the UK economy unexpectedly shrank in January due to lower manufacturing output - and has only grown in two of the past six months. In layman’s terms, that means the economy is narrowly avoiding a downturn, and the government isn’t delivering on its promise of growth.

The Bank of England will be getting pressure to cut the base rate sooner rather than later, as this will give the economy a temporary boost. However, the Bank’s priority is stability over short-term gains. Plus, lowering rates too soon could risk inflation increasing as it encourages people to spend more, which could cause price hikes.

But the current government’s careful approach to public finances, and their desire to not break their own spending and tax rules, means they are in a tight spot when it comes to things they can do to boost the economy.

This is part of the reason it’s rumoured that Rachel Reeves is considering cutting the Cash ISA annual allowance from £20,000 to £4,000. Supposedly this will encourage more people to invest in Stocks & Shares ISAs instead, which would help to boost the UK economy.

But investing might not feel the right approach for cautious savers, or those saving up for more immediate, but still considerable goals - like a house deposit or wedding. Risking your entire house fund on the stock market will feel - understandably - a bit too big of a gamble for many aspiring home buyers!

Get up to £1,000 free towards a house deposit

Save up to £4,000 per tax year in a Lifetime ISA, and get a free 25% boost to your savings. Plus, with a Tembo Cash Lifetime ISA, you’ll earn our market-leading interest rate.

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

How does the base rate impact the housing market?

When the base rate goes up, this makes borrowing more expensive for banks, building societies and saving providers - so they often raise their own interest rates in response. This is good news for savers, as higher interest rates mean you’ll earn more interest on your funds. But this can be bad news if you want to borrow money, as it makes taking out loans for things like mortgages, cars or personal finance more expensive.

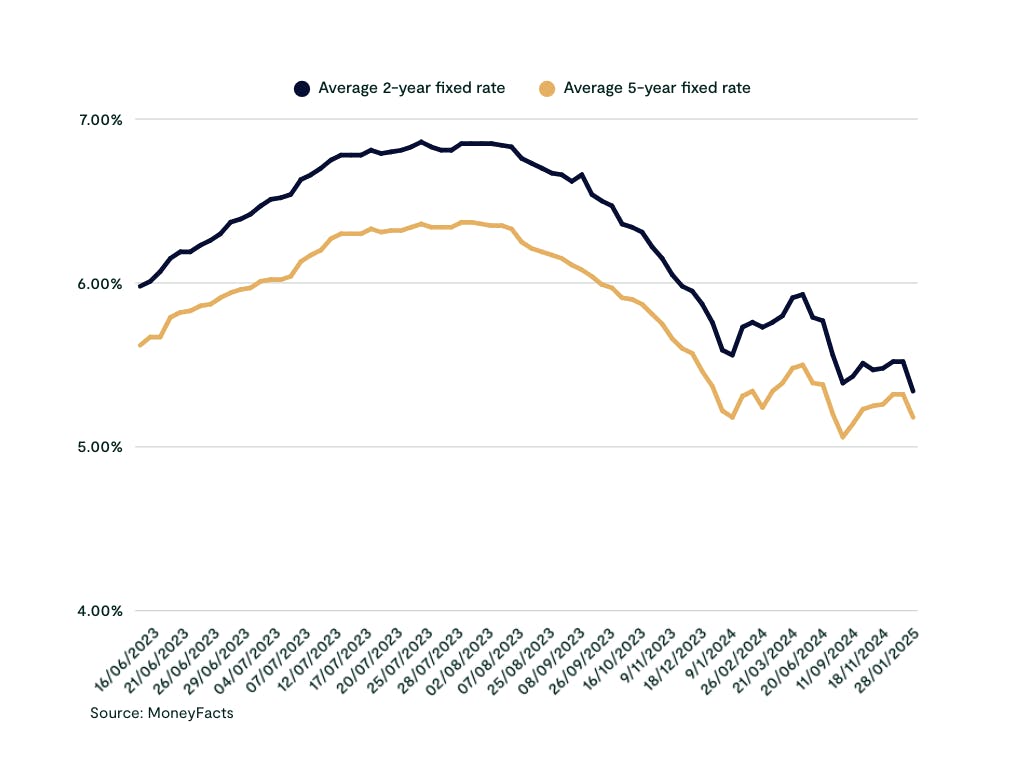

When mortgage rates increase because the base rate goes up, this makes getting a mortgage more expensive as you’ll pay a higher rate of interest on what you borrow, increasing your monthly payments. If it stays the same, this can stagnate buying demand if more buyers wait for the next cut to get on the ladder.

This can be a good thing if you can still afford to buy a home even with the higher rates. You’ll have to accommodate higher repayments, but you may have fewer buyers to compete with - which could prevent you get outbid by other buyers, or even help you negotiate on house price!

You might like: How to negotiate on house price?

On the flip side, when the base rate gets cut, so does the cost of borrowing, so interest rates often tend to follow suit. This makes getting on the ladder more affordable, but can also increase buyer demand. With more home buyers on the market, house prices can increase, which can mean you’re outpriced of certain purchases, or have to put down a bigger offer to secure a property.

If you are remortgaging, the base rate going up or staying at the same level could mean your monthly repayments will go up too if your current fixed rate is lower than what’s offered on the market.

If you’re reaching the end of a fixed rate deal with a 2-3% rate, it’s likely you’ll remortgage at a higher rate due to the current rates offered on the market. Locking in a rate earlier to ensure you don’t automatically go onto your lender’s SVR - which is on average 7.78% - can help protect you from rate rises.

If you’re on a variable rate deal and the base rate increases - around 600,000 homeowners - you’ll likely see an immediate increase to your monthly payments if the base rate goes up.

With Tembo’s free rate checking service, if you’ve locked in a deal with us and rates drop, simply contact your dedicated mortgage adviser and they’ll reapply for you at no extra cost. If rates go up, you’ve already locked in a lower rate - so it’s a win-win!

Worried about rising mortgage costs?

Whether you’re a homeowner or a home buyer, if you want to see how market changes impact your affordability, create a free Tembo plan today. You can see what rates you could be offered and the monthly costs without having to apply for a mortgage.

When will the base rate go down?

The Bank of England has made it clear that it wants to see sustained lower inflation before considering a base rate cut. Not only has inflation increased, but the Bank expects inflation to keep climbing, spiking at 3.7% between July and September this year. Supply chain disruptions, tariff changes, as well as ongoing conflicts and climate change like the recent hurricane Helene could also contribute to keeping inflation high, forcing the Bank to delay cuts further.

Right now, the base rate is expected to be cut multiple times from May 2025 onwards, ending 2025 at 3.75%, with mortgage rates following, ending at an average of 3.63% by the end of the year.

So if you’re holding out for drastic cuts to mortgage rates, you might be waiting a while. While mortgage rates go down gradually, many aspiring borrowers will either have to accommodate higher borrowing costs to get on the ladder - or be prepared to hold out for more rate cuts to come.

This might sound disheartening, but if you can afford to buy now the base rate hold could be a good thing.

While mortgage affordability is stretched, this reduces the number of buyers who can afford to get on the ladder, meaning there are fewer buyers to compete against. Weaker demand means house prices could stagnate or even go down, while sellers could be more open to price negotiations if they are struggling to sell.

Holding off buying could cost you

If you waited out until the end of the year for lower rates to buy, on average you’d save £37 per month or £900 over a two-year fixed-term. But with predicted house price rises and the upcoming changes to stamp duty, buying a home at the end of the year would cost £2,346 more in deposit and stamp duet costs vs now.

See what you could afford now with a free Tembo mortgage recommendation!

How does the base rate impact saving rates?

When the base rate increases, this makes borrowing more expensive for saving providers - so they often raise their own saving interest rates in response. This is good news for your savings account, as the higher the interest rate the more you’ll earn in interest. As a rule of thumb, ensuring your interest rate is above inflation - so above 3% - helps to protect the buying power of your savings.

Maximise your savings with Tembo

We offer a range of ISA savings accounts to help you save for your life goals tax-free, from our competitive, easy-access Cash ISA to our market-leading Cash Lifetime ISA.

Tax treatment depends on individual circumstances and may be subject to change in the future. When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.