Do you pay tax on savings in the UK?

A few years ago, you’d need to be a high earner or have a lot of money in the bank to pay tax on your savings interest. But with interest rates rising, more people are paying tax on their savings in the UK. In fact, in the 2023/24 tax year, an estimated 2.73 million people were hit by this type of tax, compared to just 800,000 savers in 2020/21. So how much tax do you pay on savings and is there anything you can do to avoid it?

Tax treatment depends on individual circumstances and may be subject to change in the future

Do I have to pay tax on my savings?

Most people can earn some interest from their savings without paying tax, thanks to a number of government allowances including the Personal Allowance, Personal Savings Allowance and the starter rate for savings allowance. You can also save up to £20,000 each year tax-free if you keep your savings in Cash ISA accounts.

But how do these allowances work?

Earn up to £1,000 of tax-free interest each year with the Personal Savings Allowance

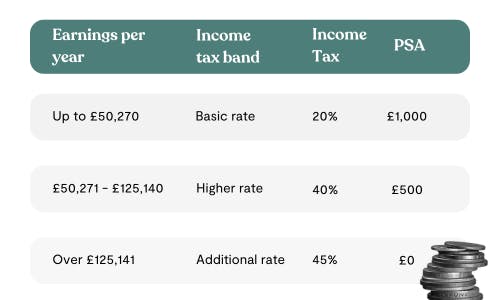

You may be able to earn up to £1,000 of tax-free interest each tax year, thanks to the Personal Savings Allowance (PSA). Your PSA will depend on your tax bracket. Basic-rate taxpayers get the full £1,000 allowance, while higher-rate taxpayers get a £500 allowance.

If you’re an additional rate taxpayer, you won’t have a Personal Savings Allowance, but you could reduce the amount of tax you pay on savings interest by making the most of your £20,000 ISA allowance each year. We’ll talk about this in more detail later!

Earn less than £17,570 from your work or pension? You may have additional allowances

Everyone can earn £12,570 each year without paying tax on this portion of your income. If you earn less than this from your wages, pensions or other types of income, the remainder of your Personal Allowance can be used to protect your savings interest.

You’ll also have additional protection if you earn less than £17,570 a year from your wages, pensions and other types of income, thanks to a lesser-known allowance known as ‘starter rate for savings’.

This lets you earn up to £5,000 in savings interest each year without paying tax on it. The exact allowance will depend on your income. Every £1 of income you earn above the £12,570 Personal Allowance will reduce your starting rate for savings by £1.

So, if you earn £16,000 a year from part-time employment, for example, the portion of your wages above your £12,570 Personal Allowance will reduce your starting rate for savings by £3,430. This means you can earn up to £1,570 in savings interest each year without paying tax on it. If only the tax system wasn’t so complicated!

How much tax do you pay on savings?

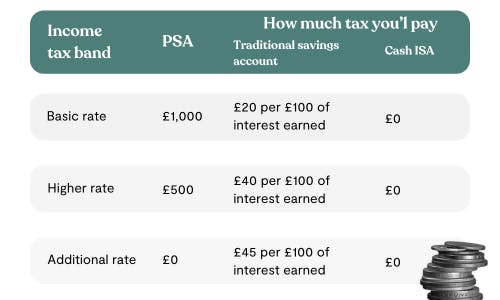

The amount of tax you’ll pay on your savings interest will depend on your tax bracket, how much you’ve saved and where you keep your savings.

Take a look at the table below to see how much tax you can expect to pay based on your tax bracket and whether you’re saving in a traditional savings account or a tax-efficient ISA.

ISAs to the rescue!

If you’re saving for a large expense such as a wedding, holiday or house deposit, you can protect up to £20,000 a year from the taxman with the help of an ISA. An ISA is simply a type of savings or investment account, but the money held within it is completely tax-free - as long as you save up to the £20,000 annual allowance.

There are a number of different types of ISAs to choose from, such as Cash ISAs, Stocks and Shares ISAs and Lifetime ISAs.

If you’re saving for big milestones such as starting a family, moving home, holidays, furniture or emergencies, you’ll be better suited to a Cash ISA. Some Cash ISAs give you additional perks for saving with them, so if you need to access your money quickly make sure you opt for an easy-access account!

Save for your future faster with our competitive, easy-access Cash ISA

Save up to £20,000, tax-free every year with a Tembo Cash ISA, where you'll have access to our competitive interest rate of 4.64% AER (variable), unlimited same-day withdrawals, fee-free mortgage advice, and monthly paid interest. Open with as little as £10 today

The right ISA for you will depend on your savings goals and attitude to risk. If you’re saving for your first home, for example, a Lifetime ISA could help you get on the property ladder sooner. Save up to £4,000 in your Lifetime ISA each year and the government will boost your savings by 25%. You can also use a Lifetime ISA for retirement!

If you don’t need your money for the next 5, 10 or 15 years and you feel comfortable taking on a bit of risk, a Stocks and Shares ISA can often outperform Cash ISAs over a longer period of time - although this isn’t guaranteed.

If you’re trying to tackle multiple goals at once, you don’t have to pick just one type of ISA. You could have a Cash ISA and a Lifetime ISA, for example, or more than one cash ISA at once.

How do you pay tax on savings?

Most people who pay tax on their savings do so without having to take any action at all. If you’re employed or you receive a pension, HMRC will usually change your tax code to take extra tax from your income. For savings interest, this tends to be automatic.

If you earn between £1,000 and £10,000 in dividend income, however, you’ll need to tell HMRC. If you earn more than £10,000 from savings and investments, you’ll need to report this income via a Self Assessment tax return, even if you’re in full-time employment.

If you’re self-employed, you can report your savings and investment income as part of your usual tax return.

If neither of the above applies, HMRC will contact you if you owe tax on savings interest. You’ll need to inform them of any dividend interest.

Do pensioners pay tax on savings?

Yes, pensioners pay tax on their savings interest, but even in retirement, you’ll still be protected by the Personal Savings Allowance. If you earn less than £17,570 in pension income each year, the starting rate for savings allowance could give you an additional boost.

Pensioners can also protect up to £20,000 each year from HMRC with the help of Cash ISAs and Stocks and Shares ISAs. You must be aged 39 or younger to open a Lifetime ISA, but if you already have one, you can continue to pay into it until the age of 50 and access your savings for retirement from age 60.

Open a Lifetime ISA today to start saving for your first home or retirement

Save up to £4,000 each tax year and you’ll get a free 25% bonus from the government. The money you save or invest, plus the interest or investment gains are totally tax-free.

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.