How much should I have in savings?

When you research how much you should have in savings, you’ll probably find various rules about how much you should have. But there are a number of factors that can affect your ability to save for the future, such as your age, income, relationship status and whether you rent or own your home. So whether you’ve got some money tucked away in a Cash ISA or you’ve barely enough to fund a Deliveroo, don’t compare yourself too much to others! In this guide, we’ll myth-bust how much the majority of people actually have in savings, and what is a good goal to aim for is.

Getting a mortgage? You deserve a Tembonus

With our HomeSaver savings account, there'll be a reward waiting for you at the finish line, whether you're buying your first place, your next, or remortgaging.

What are the average savings by age in the UK?

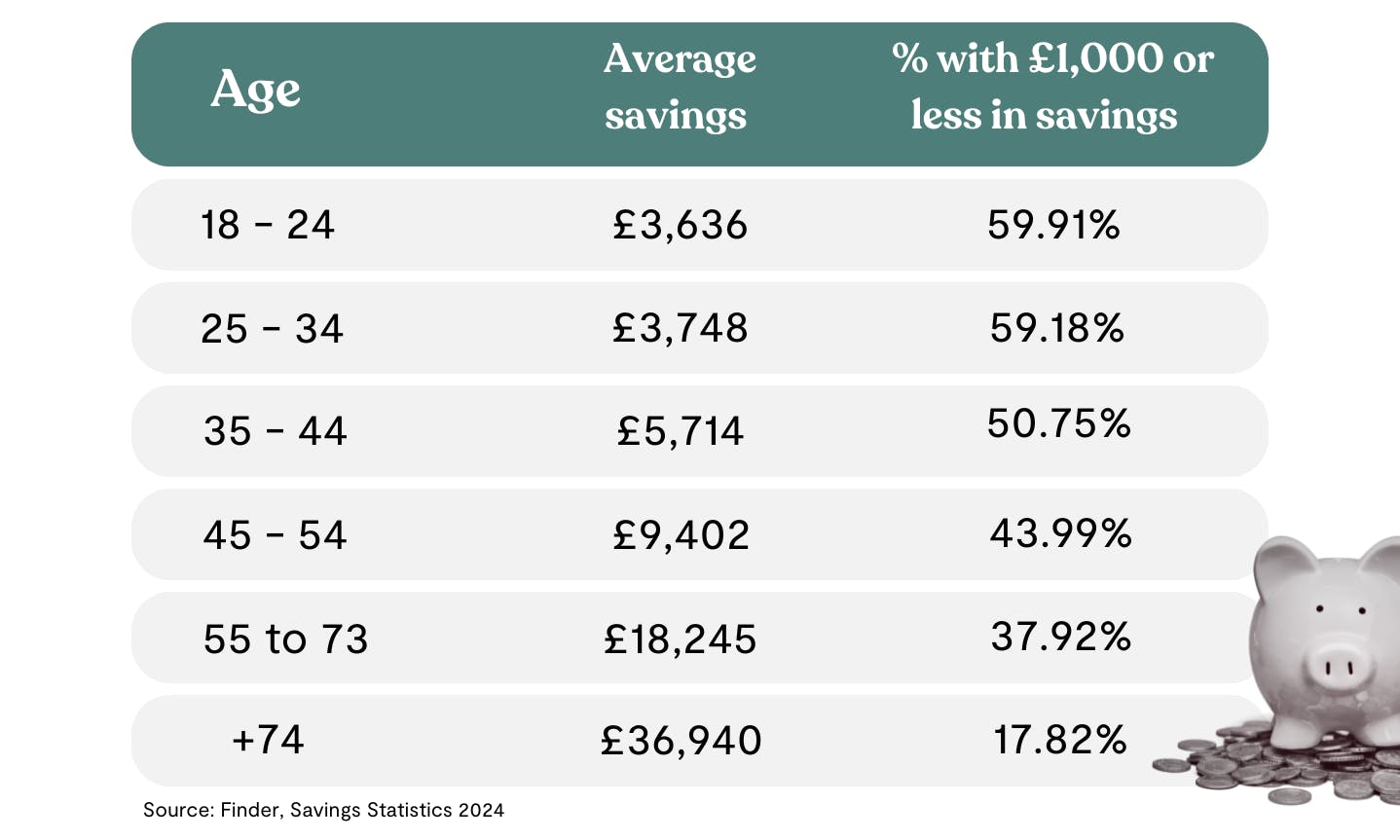

Your age can play a significant role in your ability to save. Older generations tend to have more in the bank than Millennials and Gen Z savers, which is helped by the fact that over 75% of all property wealth in the UK is owned by the over 55s. Owning a home makes you better off in the long run than renting a similar property, as you are not only protected from rising rent costs but also can build up your own property equity over time. The older you are, the more you tend to take home each month in earnings.

Those aged 18-34 have on average under £3,800 in savings, while those aged 35-44 have £5,700 on average. This grows to closer to £10,000 when you get to the 45-54 year olds, and closer to £20,000 or more for the 55s and up.

However, these averages can make it seem like everyone but you has money put aside, when this isn’t the case. Almost 60% of those aged 18 to 34 have less than £1,000 in savings.

And although the average 55 to 73-year-old has almost £20,000 in savings, almost 38% of those in that age bracket have less than a grand tucked away. Across all age groups, a quarter of UK adults (11.5m people) have less than £100 in their savings accounts, with one in six people having no savings at all.

So if you’re struggling to save, you’re certainly not alone!

Let’s take a look at some of the factors that can affect how much you have in savings:

Your income impacts your ability to save

Your income is another metric that determines how much you’re likely to have in savings. People with higher incomes tend to have more disposable income than those on lower incomes, making it easier to save for the future.

However, saving can still be a challenge even with an above-average salary. As our income increases, we might move to a bigger house, drive a better car and go on more holidays, resulting in larger mortgage payments or rent, energy bills and expenses.

This is often referred to as ‘lifestyle inflation’. There’s nothing wrong with spending more money following a pay rise, but it can make it harder to get out of debt, save for retirement, and cope with financial emergencies or a loss of income.

Renting can make it harder to save

Many renters find it harder to save for the future than they would if they had a mortgage or owned their home outright. This is partly because renters tend to spend a greater percentage of their income on housing than other households - 81% of renters in the UK are spending more than 30% of their take-home pay on rent. While mortgage holders tend to spend around 20% of their earnings on mortgage payments.

More than a quarter of renters have no savings and half reported having less than three months’ worth of rent set aside - so it’s no wonder that so many renters struggle to get on the property ladder!

To make matters worse, many renters have seen their living costs increase over the last few years, due to landlords passing on higher mortgage rates and regulatory costs to tenants.

… but homeowners don’t necessarily have it easy

Although renters can find it harder to save than homeowners, even those who’ve gotten onto the property ladder can struggle to grow their savings.

Mortgage rates have risen significantly over the last few years and for many homeowners, this has caused an increase in their monthly expenditure.

Up to 1.5m households are expected to reach the end of a fixed-rate mortgage deal in 2024, leading to then remortgaging onto a new deal. This could cause an annual increase of £1,800 for a typical family.

Struggling with the cost of your mortgage?

We can help you find ways to reduce your monthly payments, making it easier for you to save for holidays, emergencies and retirement. Find out how much you could borrow with our remortgage calculator, or create a personalised Tembo recommendation to see all your options.

The singlehood penalty

If you’re single or you live alone, you may find it harder to save for the future than those who are in a relationship and living with their partner or spouse. People who live alone spend 92% of their disposable income each month compared to those in two-adult households who spend 83% of their disposable income. It’s hard to save for the future when you’ve got no one to split your subscriptions and utility bills with. And don’t get us started on the cost of attending a wedding alone!

If you’re trying to buy a house on your own, we can help. We’ve helped thousands of first-time buyers to boost their affordability and get on the property ladder, even with a small deposit. Get started today by creating a free, personalised mortgage recommendation.

Health is wealth

Half of working-age people with poor health have no savings whatsoever, compared to 35% with good health. This is partly because people with poor health tend to have a lower household income, and may also face higher costs such as higher heating bills or home adaptation costs, leaving them with less remaining income to save.

How much should I have in savings?

It’s difficult to say exactly how much you should have in savings because everyone’s situation and goals are different. As a general rule, it’s a good idea to have 3-6 months of living expenses set aside for an emergency. But in the current cost of living crisis, this can be a hard goal to aim for, so instead focus on setting yourself a much more realistic goal and going from there. This could be something like having £1,000 saved up by the end of the year. Save this money in an account you can access easily, but won't dip into when you want to buy something online you like - like a savings account or easy access Cash ISA with a competitive interest rate.

You might also like our guide on How much should I save each month?

Earn 2.7x more interest with a Tembo Cash ISA vs saving with the Big 4 banks

Earn the market-leading rate of 4.1% AER (variable) with Tembo's Cash ISA. That's over £400 more in interest over 5-years if you save with Tembo*! Get started today. Download the award-winning Tembo app and open a Cash ISA with just £10.

Once you’ve got an emergency fund, you can start working towards other goals such as saving a house deposit, travelling around Europe or paying for home improvements.

If you’re hoping to buy a home in the next few years, a Lifetime ISA will help you reach your house fund target much sooner. You can save up to £4,000 a year in a LISA and the government will boost your savings by 25% — meaning you could get up to £1,000 a year off the government towards your first home every year!

If you’re hoping to buy a home in the next few years, a Lifetime ISA will help you reach your house fund target much sooner. You can save up to £4,000 a year in a LISA and the government will boost your savings by 25% — meaning you could get up to £1,000 a year off the government towards your first home every year!

Wondering where to start? Take a look at our guide on how to save money for our top saving tips.

What is the ideal amount to have in savings?

A good rule to follow is to try to put 20% of your take-home pay into savings each month. This should go towards building up your emergency fund or saving for long-term goals like buying your first house, funding a holiday or saving up for retirement. If you would struggle to save 20% of your earnings each month, start with what you can and build it up from there. Look at ways to reduce your spending by creating a budget (and sticking to it) and exploring ways to increase your earnings, like upskilling at work, asking for a pay rise or switching jobs for better pay.

The important thing is to start saving, and not to compare yourself too much to your friends, family or people on social media. Saving is tough, so starting today is the best thing you can do, even if you can only save a small amount!

Save faster for your first home with the market-leading Cash Lifetime ISA

Save up to £4,000 per tax year in our Cash Lifetime ISA that comes with a market-leading 4.1% AER interest rate (variable). Plus, get a 25% government bonus of up to £1,000 per tax year to boost your first home deposit or retirement pot. Download our app and start by adding just £1.

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

You might also like

*Based on saving £100 at the beginning of each month for 5-years. Calculations show at month 61 (after 5-years) Tembo customers saving at 4.10% would have £436.62 on average more than saving with Barclays, HSBC, NatWest or Lloyds. Accurate August 2025.