How can I lower my mortgage payments?

Your mortgage is likely to be your biggest expense as a homeowner. If your mortgage payments are affordable, you’ll find it easier to keep up with your other living costs, spend money on things you enjoy and hopefully save for the future. If your mortgage payments are unaffordable, this can impact every aspect of your life, from your finances to your mental health.

Whether you’re struggling with the cost of your mortgage or you’re looking to reduce the amount you spend on interest, discover the ways to lower your mortgage payments in this guide.

Do mortgage repayments get cheaper?

Some people’s mortgage repayments can get cheaper over time, but it depends on the type of mortgage you have. If you have a fixed-rate mortgage, your interest rate and mortgage payments will stay the same for the duration of your fixed-rate period. When you reach the end of your fix, your lender will usually move you onto its Standard Variable Rate (SVR), unless you remortgage to a new deal. If your lender moves you onto a higher interest rate, your mortgage repayments will get more expensive than before. If you’ve moved onto a lower interest rate, your mortgage repayments will get cheaper.

If your fixed-rate period is set to end in the next 6 months or you’ve already been moved onto your lender’s SVR, it’s a good idea to compare remortgage deals to see if you can get a better one. As we’ll explain in more detail later, remortgaging your home or applying for a product transfer could make your repayments cheaper.

See today’s best remortgage rates

Don’t settle for your lender’s SVR. Quickly compare current rates from across our panel of over 100 lenders with our simple tool. Or create a free Tembo recommendation for a personalised remortgage rate.

The interest rates shown are an indication only and are not guaranteed. Current rates may have changed by the time you come to apply.

Can I pay down my mortgage to lower my monthly payments?

Yes, it’s often possible to lower your monthly payments by overpaying your mortgage, but this is often limited to a percentage of your outstanding loan. It’s typical for you to only be able to overpay by 10% of your outstanding mortgage each year, but some lenders may allow you to overpay more or less than this. Whether overpaying is the right move for you will depend on your goals.

When you first contact your lender to and ask to make an overpayment, they may give you two options:

- Reduce your monthly payments by the amount you’ve overpaid

- Keep your monthly payments the same and reduce your mortgage term instead

The right option for you will depend on what you want to achieve. If you want to lower your monthly payments, choose option one. If you want to pay your mortgage off sooner and reduce the amount of interest you’ll pay overall, choose option two. We’ve talked about overpayments in more detail later on in the guide.

Learn more: How can I get a lower interest rate?

If you can’t afford your mortgage payments, you’re not alone. Over the last two years, interest rates have risen from 0.1% to 5.25% — the highest it’s been since the financial crisis of 2008. Around half of mortgage holders (4.5 million households) have experienced increases to their monthly payments during this period. For many households, they have seen their mortgage payments increase by hundreds of pounds.

How to lower your mortgage payments:

1. Remortgage

If your mortgage payments have become unaffordable, you may be able to reduce your monthly costs by remortgaging your home. This involves switching your current mortgage for a new deal with a different lender. Remortgaging can sometimes give you access to better interest rates and terms, but you’ll need to compare mortgages from across the market to find the right deal for you.

We can help with this — our award-winning smart decisioning technology compares your eligibility to thousands of mortgage products in seconds to generate a personalised recommendation just for you. Then, our team of mortgage experts will complete the qualification process to get your remortgage under way. Get started here.

2. Product transfer

If you can’t afford your mortgage payments, a mortgage product transfer could help you reduce your outgoings. A product transfer is similar to a remortgage, but instead of switching to a new lender you’ll stick with your existing one.

Lenders tend to carry out more basic affordability checks when moving a customer from one product to another. This means the product transfer process can be more straightforward than remortgaging to a new lender. If your income or circumstances have changed since you took out your current mortgage, this can make it easier to overcome common affordability issues and secure a new mortgage deal.

The downside of a product transfer is that you may miss out on better and more affordable mortgage deals from other lenders. That’s why it’s a good idea to create a free Tembo recommendation - it only takes 10 minutes complete. At the end, you’ll find out if it’s worth staying with your current lender, or switching to a new one.

3. Switch to an interest-only mortgage

Switching to an interest-only mortgage will help to lower your monthly payments, but it won’t be right for everyone. Most residential mortgages are repayment mortgages. With this type of mortgage, you’ll pay back a small part of your loan and interest each month. If you make all your payments, your loan will be fully repaid at the end of your mortgage term. With an interest-only mortgage, however, you’ll just pay the interest each month. At the end of your mortgage term, you’ll need to repay the amount you borrowed in full.

Repayment mortgages can be a safer option for those with a steady income, since the debt will be repaid gradually rather than in one go. But if you’re expecting a large windfall such as an inheritance in future, an interest-only mortgage can make your repayments more manageable in the short term.

Interest-only mortgages are popular among Buy to Let landlords, with some property investors selling their investments at the end of the mortgage term to pay off the capital. However, if you’re unable to repay the capital at the end of your term, you might need to sell your home to pay off your debt.

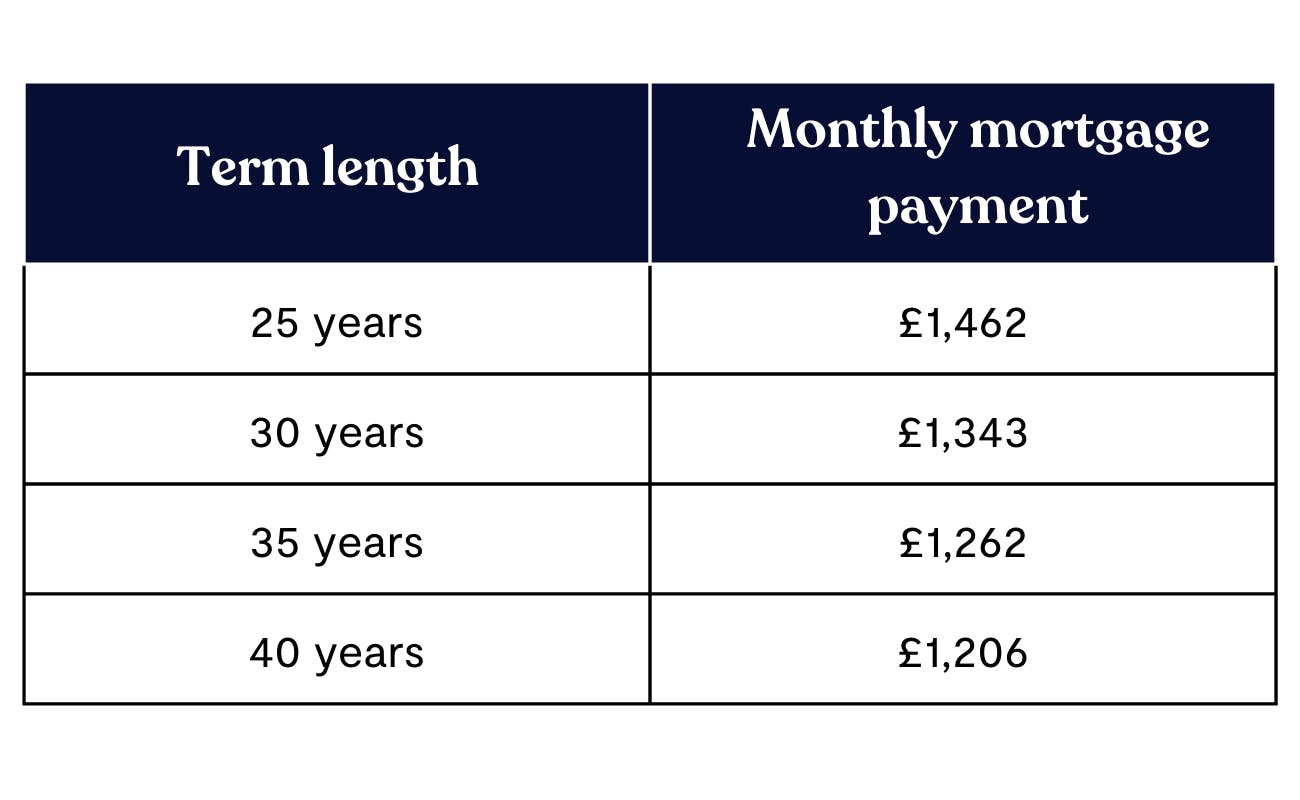

4. Choose a longer mortgage term

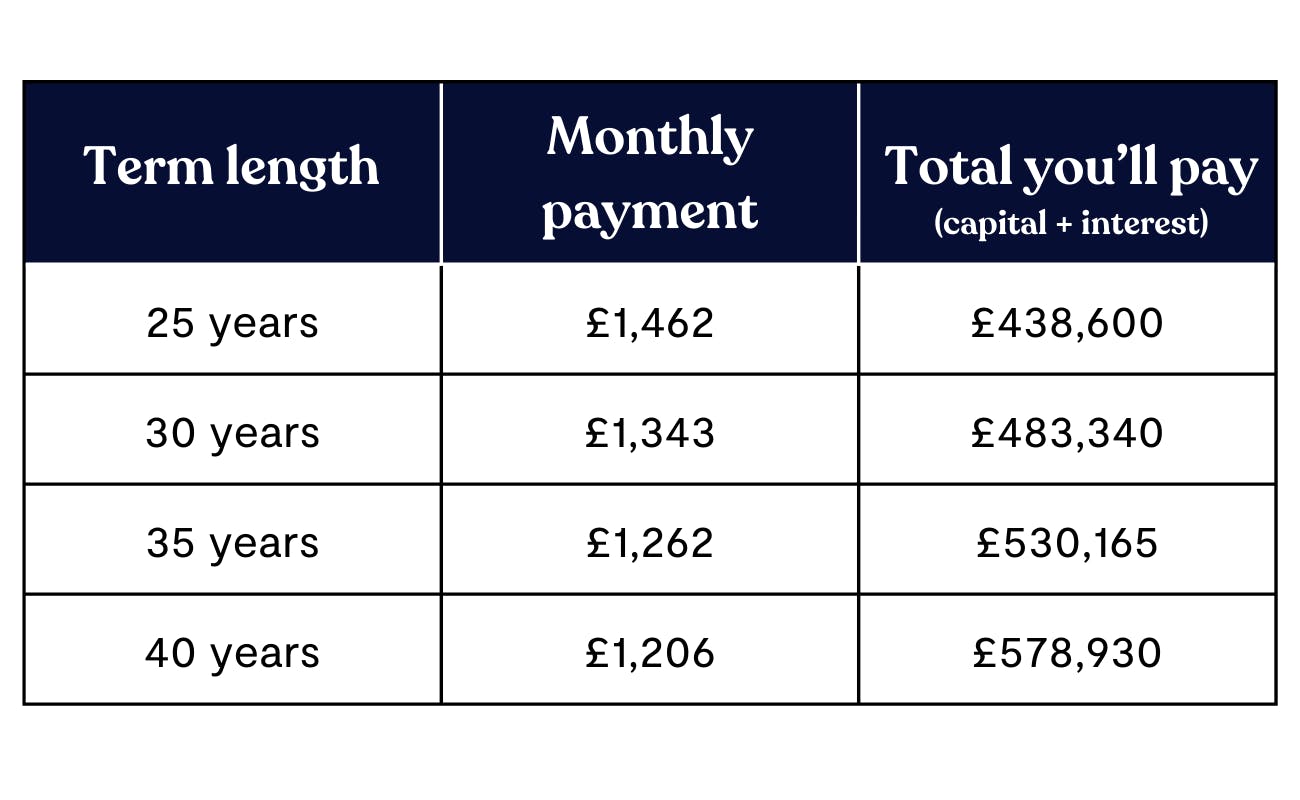

The longer your mortgage term, the lower your mortgage payments will typically be. This is because your mortgage debt is spread across a longer period of time. However, although a longer mortgage term can make your payments more affordable month-to-month, it will increase the amount of interest you pay overall.

Take a look at the graph below to see how your monthly payments can vary depending on the length of your loan.

Now, let’s look at the above figures alongside the overall cost of the mortgage:

The above figures are based on a £250,000 mortgage with an interest rate of 5%.

5. Ask for a mortgage holiday

If you’re struggling to afford your mortgage payments, speak to your lender as soon as possible, they might offer you a mortgage holiday. A mortgage holiday involves pausing your payments for a set period of time, which can relieve some pressure and make it easier for you to get your finances back on track.

Although a mortgage holiday allows you to pause your repayments, you’ll need to pay the money back eventually. When your mortgage holiday ends, your outstanding balance and mortgage payments will be higher than they were before you paused your payments.

6. Consider a shared ownership mortgage

If you’re struggling to save a deposit big enough for the home you want and the mortgage payments on your ideal property would be unaffordable, shared ownership could help you get on the ladder sooner.

Rather than putting down a deposit on your chosen property and taking out a large mortgage to cover the rest, a shared ownership mortgage lets you purchase a share of the property and pay rent on the rest. Over time, you can gradually work your way up to full ownership by buying more of the property when you can afford it.

Wondering if shared ownership the right option for you? Let us help you.

See how you could lower your mortgage payments today

Here at Tembo, we work with more than 100 lenders to find the best deal for our customers from thousands of mortgages. We also help first-time buyers and existing homeowners to overcome common mortgage obstacles and affordability issues which could prevent them from accessing lower rates. To get started create a free Tembo recommendation today.