What is a Cash ISA?

A Cash ISA is a special type of savings account where you can earn tax-free interest. Anyone over the age of 18 can open one - they’re particularly useful if you’ve already maxed out your LISA allowance for this year and want to save more, or you’re a higher-rate or additional-rate taxpayer.

How does a Cash ISA work?

A Cash ISA stands for a Cash Individual Savings Account, and is a special savings account that lets you save up money free from income tax. If you’re a basic-rate or higher-rate taxpayer, some of the interest you earn will already be tax-free, thanks to the personal savings allowance (PSA). But, if the amount of interest you earn exceeds your personal savings allowance, any interest above your limit will be taxed - unless you place your savings in an ISA.

What is my personal savings allowance?

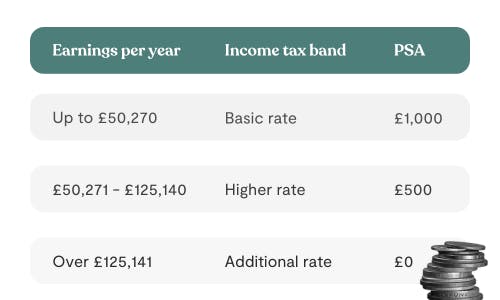

If you earn up to £50,270 per year you’re a basic-rate taxpayer, which means you can earn up to £1,000 in savings interest each year without paying tax. If you’re a higher-rate taxpayer (you earn between £50,271 to £125,140), you can earn up to £500 in tax-free interest each year. Additional-rate taxpayers (who earn over £125,141 per year) have no personal savings allowance.

How do I open a Cash ISA?

It’s really easy to open a Cash ISA, as most providers let you open one online or by downloading an app. Once you’ve signed up to a cash ISA with a provider, you can deposit money into the account. Then your tax-free interest will be paid into your ISA, normally monthly or annually depending on your provider.

How much can you put in a Cash ISA?

You can put up to £20,000 in a cash ISA each tax year, which runs from the 6th April to the 5th April. The money can be spread across different types of ISA, including Cash ISAs, Stocks & Shares ISAs, Lifetime ISAs and Innovative Finance ISAs. The cap on the total amount you can add to your ISAs each year is known as your ISA allowance.

Save for your future faster with our competitive, easy-access Cash ISA

Save up to £20,000, tax-free every year with a Tembo Cash ISA, where you'll have access to our competitive interest rate of 4.8% AER (variable), unlimited same-day withdrawals, fee-free mortgage advice, and monthly paid interest. Open with as little as £10 today

How many Cash ISAs can I have?

You can have as many cash ISAs (or other types of ISAs) as you like, as long as you don’t exceed your £20,000 ISA allowance in any given tax year. If you’re saving a deposit to buy a house, you may be better suited to a Lifetime ISA than a regular cash ISA. You’ll still be able to earn tax-free interest on your savings, but this time your savings will benefit from a 25% boost from the government, which you can put towards your first home or retirement.

Lifetime ISAs explained:

You can save up to £4,000 each tax year in your LISA, so if you max out your account for 3 years in a row, you’ll bag a £3,000 bonus from the government during this period, bringing your total deposit to £15,000. If you’re able to save more than £4,000 a year, you could put any additional savings in a regular cash ISA. After all, you’ll still have £16,000 of your annual ISA allowance left!

There are two types of LISA to choose from: a Cash LISA and a Stocks and Shares LISA. The right LISA for you will depend on your circumstances. No matter which one you choose, you can open a LISA quickly and easily with Tembo. Keep in mind that a Lifetime ISA has different restrictions and eligibility criteria compared to ISAs, it’s important to understand these before opening a LISA. For example, withdrawals from a Lifetime ISA for any purpose other than buying a first home (up to a value of £450,000) or for retirement incur a 25% government penalty, meaning you may get back less than you paid in. You’ll also need to have your Lifetime ISA open for a year before using it to buy a property, though the clock won’t start ticking until you’ve put at least £1 in.

Can a Cash ISA lose money?

A Cash ISA won’t lose money, unlike a Stocks and Shares ISA where the value of your investments can rise and fall depending on changes in the stock market. However, if inflation is higher than your ISA’s interest rate, the money you hold in a Cash ISA will lose its buying power. So although you can access your money at any time and you might even withdraw more than you deposited (thanks to interest) it might not go as far in a few years’ time.

If you’re worried about the money in your Cash ISA losing value over time, you may be better suited to a Stocks and Shares ISA or a Stocks and Shares Lifetime ISA.

A Stocks and Shares ISA tends to be best for long term goals such as retirement. The value of your investments can fluctuate from one day to the next, but if you keep investing for 10, 20 or even 30 years, you’ll usually see a much greater return than you would if you kept the money in cash.

A Lifetime ISA may be best if you’re saving for a property, since not only will you earn tax-free interest, you’ll also earn a 25% government bonus - which can’t be beaten anywhere else.

Take a look at our cash ISAs vs Cash Lifetime ISAs guide to learn more.

Which Cash ISA should I choose?

The right Cash ISA for you will depend on your goals and how soon you plan on using the money. If you want easy access to your cash whenever you need it, choose an easy-access Cash ISA. You can usually get a better interest rate if you’re willing to lock your money away in a fixed-rate Cash ISA. Your interest rate will be fixed for an agreed period of time, but you’ll need to pay a fee to access your cash before the fix ends.

A 'Notice Cash ISA' is a type of Cash ISA that will allow you to lock away your funds for a set period of time. You’ll need to give a certain number of days’ notice before withdrawing your money. Again, accessing the funds sooner could result in a fee. However, Notice Cash ISAs will tend to offer better interest rates than easy-access Cash ISAs.

Learn more - Best Cash ISAs in the UK right now

Join the 350,000 others already saving with us

Download the award-winning Tembo app to start saving towards your first home, retirement, or another life milestone.