Cash ISA vs Lifetime ISA: Which should I pick?

If you’re saving a deposit for a house, the right savings account could help you get on the ladder sooner. But which type of savings account should you choose? Let’s take a look at two of the most tax-efficient and rewarding options: the Cash ISA vs Lifetime ISA.

Why do I need an ISA?

ISAs provide you with a tax-efficient way to save up for a house. Everyone gets a £20,000 ISA allowance each year. You can place the full £20,000 allowance in a Cash ISA, stocks and shares ISA or an innovative finance ISA, if you wish, or spread it across multiple ISA types including a Lifetime ISA. By having one or multiple ISAs, you can avoid paying tax on your savings interest.

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

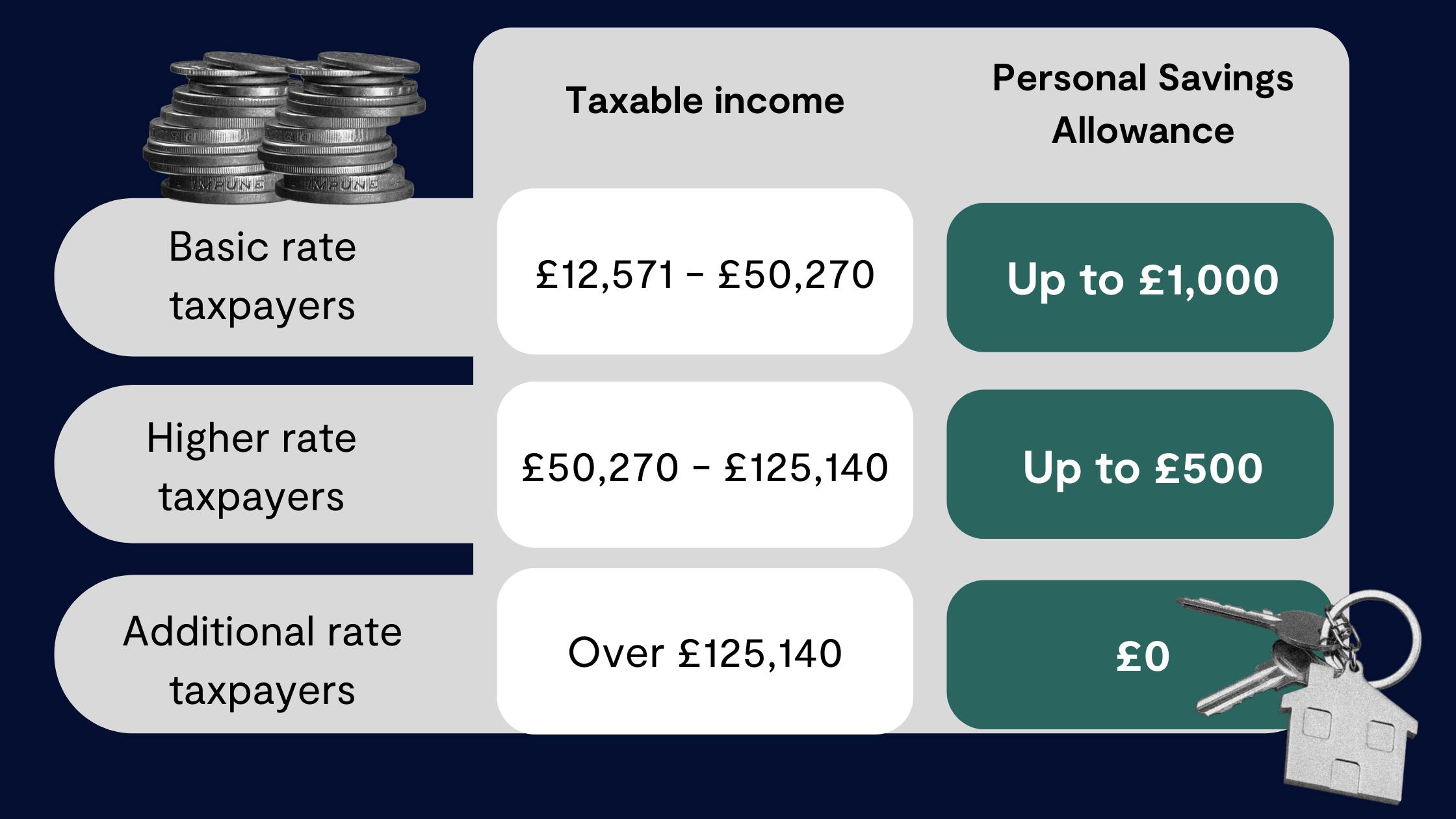

If you choose to save your house deposit fund in a normal savings account that isn’t an ISA, you might find you have to start paying tax on your savings interest. Most people can earn up to £1,000 in interest each year without paying tax on it, thanks to the government’s personal savings allowance. This means that at current savings rates, you’d need just over £20,000 in top easy-access savings accounts to exceed the allowance. But with the average first-time buyer deposit now standing at £53,414, you may see your savings become less rewarding the more money you save.

Your personal savings allowance will depend on your tax bracket:

Earn 2.7x more interest than the Big 4 banks with our competitive, easy access Cash ISA

Save up to £20,000, tax-free every year with a Tembo Cash ISA, and benefit from our 4.1% AER (variable) interest rate. That's over £400 more in interest over 5 years than if you were to save with the Big 4 banks*! Plus, unlimited withdrawals, fee-free mortgage advice, and monthly paid interest. Open with as little as £10!

What’s the difference between a Cash ISA and a Lifetime ISA?

There are a number of key differences between Cash ISAs and Lifetime ISAs. Both Cash ISAs and Lifetime ISAs are individual savings accounts which let you save your money tax-free. A Cash ISA lets you save up to £20,000 each year, to be used for whatever you like. With a Lifetime ISA, you can only save up to £4,000 each tax year, and can only use the money to buy your first home, or save for retirement. But the Lifetime ISA comes with the additional benefit of a free 25% bonus from the government on top of your contributions, which a Cash ISA doesn’t get. This means that if you max out your LISA, you’ll get a £1,000 boost to your house fund each year.

Find out all about Lifetime ISAs and the tax year here.

Another key difference between a Cash ISA and a Lifetime ISA is your ability to withdraw money. If you choose an easy access Cash ISA, you can withdraw your money at any time and spend it on whatever you want without incurring any penalties. If you choose a fixed-rate Cash ISA, your interest rate will be fixed for a set period of time, but you may lose between 90-360 days’ worth of interest if you make a withdrawal before the end of your fixed period. With a Lifetime ISA, if you use your savings for anything other than purchasing your first home or retirement, you’ll be charged a 25% penalty on the money you withdraw. This may mean you may get back less than you paid in.

Both Cash ISAs and a Cash Lifetime ISA earn interest on your savings - the rate you get will depend on the product you go for and the provider. At Tembo, our Lifetime ISA has the market-leading 4.1% interest rate AER (variable)*. That means over 5-years your deposit would increase by hundreds in interest versus choosing the next available rate on the market.

If you choose a Stocks and Shares Lifetime ISA, the value of your investments will rise and fall based on changes in the stock market.

Before choosing a particular LISA, consider what you’ll use the money for and how long it’ll be until you need access. If you plan to buy a house, you may be best suited to a Cash LISA, particularly if you’d like to buy in the next 3-5 years. Remember that you must have a Lifetime ISA open for at least 12 months before you can use it for a home purchase, and you can only use it to buy a house up to the value of £450,000. If you’re opening a LISA to save for retirement, a Stocks and Shares LISA may result in better returns over the long term.

To learn more, take a look at our Cash Lifetime ISA vs Stocks and Shares Lifetime ISA guide.

*Tax treatment depends on individual circumstances and may be subject to change in the future.

Should I switch to a Lifetime ISA?

If you already have money in a Cash ISA, moving some or all of your savings over to a Lifetime ISA could help you speed up the deposit-saving process. Both ISAs and LISAs offer tax-free interest on your savings, but you’ll only get the 25% bonus from the government with a LISA. Max out your account and you could have £15,000 within 3 years.

Choose a LISA with a competitive interest rate and it’ll be even easier. The Tembo Cash Lifetime ISA offers a market-leading rate of 4.1% AER (variable). It takes a matter of minutes to download our app and open an account.

Here are 12 reasons to use a Tembo Lifetime ISA to build your first home deposit.

Plus, unlike the Help to Buy ISA, the bonus will be paid into your LISA every 4-6 weeks. This means that you’ll earn interest on the bonus, not just your own contributions.

Got a Help to Buy ISA already? You may be able to transfer your Help to Buy ISA to Lifetime ISA.

Is it worth having a Cash ISA anymore?

A Cash ISA can be a great savings product - however, it depends on what you're saving for. If you’re a first-time buyer and you’d like to buy a property worth £450,000 or less, a Lifetime ISA may be more rewarding than a Cash ISA, but that doesn’t mean Cash ISAs aren’t worth having. If you need the flexibility to withdraw money quickly, for example to fund holidays or emergency payments, a Cash ISA might be a better choice.

Learn more: Can I keep my Lifetime ISA if I move abroad?

Can I have a Cash ISA and a Lifetime ISA?

Yes, you can open both a Cash ISA and a Lifetime ISA, and pay into both as part of your £20,000 ISA annual allowance. You can only save up to £4,000 into a Lifetime ISA each tax year, and put any additional savings into a Cash ISA. All your savings will be tax-free and you’ll also be making the most of the free 25% government bonus on your LISA savings.

Save for your first home with the market-leading Cash Lifetime ISA

Open an account with just £10 or transfer today to start benefitting from our market-leading interest rate of 4.1% AER (variable). Helping you to save for your first home, faster.

*Based on saving £100 at the beginning of each month for 5-years. Calculations show at month 61 (after 5-years) Tembo customers saving at 4.10% would have £436.62 on average more than saving with Barclays, HSBC, NatWest or Lloyds. Accurate August 2025.