Spring Statement 2025: Key takeaways for savers and first-time buyers

Today, 26th March 2025, Chancellor Rachel Reeves presented her first highly anticipated Spring Statement to parliament. If you're a first-time buyer or saving for big life goals, understanding how these changes might affect you is crucial. Here's a breakdown of the key announcements and what they mean for you.

After a controversial Autumn budget revealed back in October 2024, today’s presentation is the Chancellor’s latest financial statement, including an update on forecasts for the British economy. There was a lot of rumours about what could be announced, including potential cuts to Cash ISA annual allowances included.

Labour’s planning reforms to push housebuilding to a 40-year high

In the run-up to the election last year, Labour promised to address the UK's longstanding housing crisis by delivering “the biggest boost to affordable housing in a generation”. It seems Labour is determined to make this happen. In the Spring Statement, Reeves revealed that the Office for Budget Responsibility (OBR) has assessed Labour's planning reforms and concluded that it will lead to housebuilding reaching a forty-year high.

Changes to the national planning policy alone, she added, will help build over 1.3 million homes in the UK within the next five years and add £6.8bn to the UK economy. This is not only a major investment in housing stock but will mean Labour is within touching distance of fulfilling its manifesto pledge by building 1.5 million homes by the end of this parliament.

If you're saving for your first home, this boost in housebuilding might mean more housing options on the market in the near future. A larger supply could help stabilise or even reduce property prices in some areas, making homeownership more accessible for first-time buyers. However, these effects are unlikely to be immediate and will take time to materialise.

Stamp Duty still set to change from April 2025

For those saving to step onto the property ladder, understanding Stamp Duty - a major upfront cost - is critical. Despite the extensive housing plans, Reeves did not mention any changes to the current Stamp Duty thresholds in the Spring Statement, which are set to drop from April 2025. This means that 20% of first-time buyers will have to pay Stamp Duty charges when they buy, with the tax bill on an average-priced home in England almost doubling from £2,768 to £5,268.

Although for many home buyers the changes to Stamp Duty will feel unfair, this consistency makes it easier to plan around and know what the upfront homebuying costs will be.

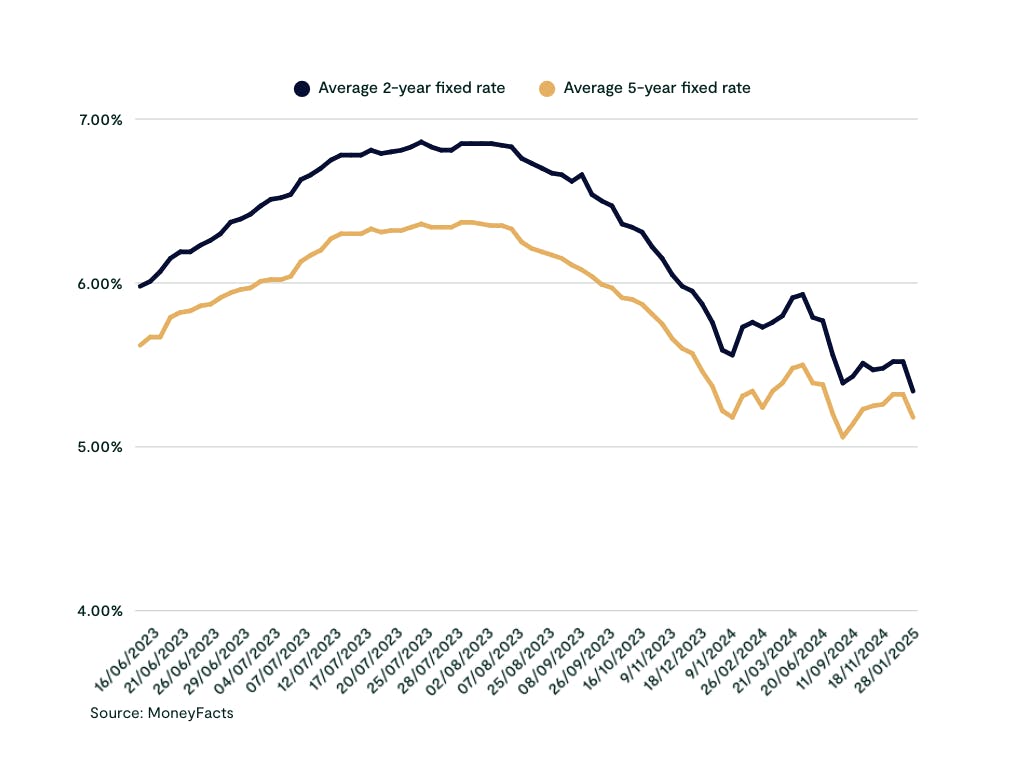

Higher mortgage rates could be here for longer

It’s likely that mortgage rates will stay higher for longer - according to the OBR, mortgage rates could go up to 4.7% by 2028, staying at that level in 2029. This is higher than the previous prediction of 4.5% back in October.

To get this figure, the OBR looked at the rates currently being paid by mortgage holders - instead of the current cheapest deal on the market. So it’s unsurprising that they’ve predicted rates are set to rise, since one third of borrowers are still on the ultra-low rates we saw a few years ago. However, the reason rates will stay elevated for longer is due to sticky inflation.

If you’re coming to the end of your fixed rate deal and you’re concerned about moving onto a higher rate, don’t stick your head in the sand. Doing nothing may mean you’ll end up on your lender’s standard variable rate (SVR), which is on average 7.99% - so although the average 5-year fixed rate deal is 5.18% right now, this is substantially lower than the average SVR.

If you’re wanting to get on the ladder, understanding what rates you could be offered can help you work out what is affordable and help you budget. Use our Compare Mortgage Rates tool to get an idea of current deals, or create a free Tembo plan to get a personalised recommendation, including indicative interest rates and repayments.

Expert advice from the UK’s Best Mortgage Broker

We've helped thousands discover their true buying budget. In fact, on average, our customer boost their mortgage affordability by £88,000! Discover what mortgage deals you could be eligible for, including indicative interest rates.

While rates staying higher for longer is not good news for mortgage holders and aspiring home buyers, it may be a good thing for savers. When interest rates stay high, this normally means saving rates do too, as saving providers are able to pass on the higher interest rates to their customers. This means that right now could be a good time to prioritise saving for long-term goals such as a house deposit, a wedding or an emergency fund.

Inflation to rise before falling

One of the contributing factors towards higher mortgage rates is inflation remaining higher. The OBR has forecasted that inflation will rise to 3.2% in 2025, which is higher than their previous forecast and above the Bank of England’s 2% target.

This expected uptick is due to a combination of volatile energy prices and lingering food price increases. While inflation is predicted to fall back down to 2.1% in 2026 and reach the Bank of England's 2% target from 2027 onwards.

For those saving for life goals like a house fund, a wedding or an emergency fund, higher inflation could erode the purchasing power of your savings. To combat this, consider placing your money in high-yield savings accounts or other financial products designed to outpace inflation.

Save for your life goals quicker

From building your first house deposit to saving for retirement, our award-winning savings and investment app helps you save towards life’s milestones faster.

Tax burden to reach historic highs

The tax burden will reach a postwar record high by the end of this parliament, the OBR has said. In its report on the UK’s finances, the independent economic forecaster said that by 2027-28, tax as a share of GDP will have reached 37.7%. For context, in 2023-24 it was at 35.5%.

A higher tax burden may limit your ability to save as you face higher deductions on your income.

This leaves you with less take-home pay, which can reduce the amount of money you have available to set aside for savings. Over time, this can make it more challenging to build an emergency fund, save for future goals, or invest in long-term financial security. Making sure you’re saving with a high-interest savings account and utilising options like a Lifetime ISA - which offers a free 25% boost on your savings - to help you maximise your money.

Withdrawals from a Lifetime ISA for any purpose other than buying a first home (up to a value of £450,000) or for retirement incur a 25% government penalty, meaning you may get back less than you paid in. Tax treatment depends on individual circumstances and may be subject to change in the future