What the 2024 Autumn Budget means for first-time buyers and the housing market

Labour had warned us that their first budget for 14-years would involve some “difficult decisions” as they look to raise £40bn for the public coffer. And after months of speculation, scare-mongering and uncertainty, on the 30th October Rachel Reeves became the first female Chancellor ever to deliver a Budget. Here's the key changes announced in the Budget that could influence the housing market.

After three-months of intense speculation, scare-mongering and uncertainty, Reeve's Budget was straightforward with very few shocks.

Richard Dana

CEO of Tembo

What does the Budget mean for first-time buyers?

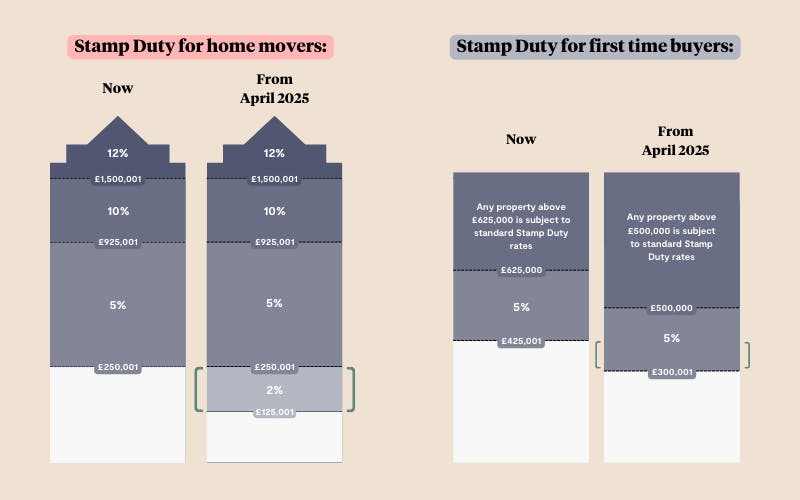

There are a couple of changes from the Budget that will impact first-time buyers. The big one is that the stamp duty threshold for first home purchases will still be lowered to £300,000, down from the current level of £425,000. This means that 20% of first-time buyers will have to pay Stamp Duty charges if purchasing from April 2025 onwards. The OBR has also predicted that changes announced in the Budget would make inflation rise to 2.5% this year, which could cause mortgage rates to fall slower than currently forecast, or rise slightly in the short term. This will make getting on the ladder more expensive, as higher interest rates make monthly mortgage repayments less affordable.

There is some good news in the Budget for first-time buyers though. The Chancellor has promised that the government will increase the supply of affordable housing through a £5bn investment plan. More homes would boost choice for first-time buyers and keep house price inflation in check - once they are built. Luckily, the contribution rules around Lifetime ISAs and other ISA accounts remain unchanged, helping aspiring home buyers benefit from saving their money tax-free into these accounts. Not to mention the 25% free bonus up to £1,000 first-time buyers can get by saving into a Lifetime ISA.

Withdrawals from a Lifetime ISA for any purpose other than buying a first home (up to a value of £450,000) or for retirement incur a 25% government penalty, meaning you may get back less than you paid in. Tax treatment depends on individual circumstances and may be subject to change in the future

What does the Budget mean for the housing market?

The Budget could significantly impact home purchases. Not only has Stamp Duty increased to 5% on second homes, but Capital Gains Tax has also increased, which could cause some buyers to reconsider buying additional properties. For home buyers, although Capital Gains Tax rates on residential property sales remain at 18% and 24%, the higher Stamp Duty thresholds will still be lowered in April 2025. This will make getting on the property ladder or moving up it more expensive if purchasing a property above £300,000 for first-time buyers and above £125,000 for home movers. Plus, the OBR has predicted that the changes announced in the Budget would push up inflation in the short term, higher than what most economists - including the Bank of England - are predicting for the next couple of years. This could mean mortgage rates fall slower than currently forecast, keeping the monthly costs of buying a home higher.

How has the Budget affected the housing market?

The one change from the Budget that has immediately affected the housing market is the increase in Stamp Duty for additional property purchases. The additional Stamp Duty rate increased from 3% to 5% from the day after the budget, leaving many second-home buyers needing to find thousands extra. How the other changes announced will impact the housing market is yet to be seen, but will become clear in the following weeks and months.

What does the new Budget mean for mortgages?

The changes announced in the Budget could cause mortgage rates to increase. Forecasts by the OBR on economic growth now predict the economy will grow faster than expected this and next year as a result of government spending increasing by almost £70bn a year, or just over 2% of GDP. But the OBR has also predicted that policies announced in the Budget would push up inflation in the short term, averaging 2.5% this year, 2.6% in 2025, 2.3% in 2026, then 2.1% in 2027 and 2028.

This level of inflation is higher than what most economists - including the Bank of England - are expecting for the next couple of years. Which could mean mortgage interest rates fall slower than currently forecast.

Read more: What is inflation and how does it impact mortgages?

We've helped thousands discover their true buying budget

On average, our customer boost their mortgage affordability by £88,000! To discover what you could afford, and see indicative interest rates, create a free Tembo plan today.

Let's go through the main changes that impact housing in more detail 👇

Stamp Duty changes

A 2% increase will hit those buying second homes on the additional stamp duty rate. This comes into effect from the day after the Budget, leaving many buyers needing to find thousands of pounds extra overnight.

The Chancellor remained silent on the upcoming changes to stamp duty relief. Back in September 2022, the threshold up to which you don't pay Stamp Duty was raised to £425,000 for first-time buyers, and £250,000 for home movers. This saved the average buyer £2,500!

We had been waiting hopefully to see if Labour might extend this relief for first-time buyers, but no such luck. As of April next year, first-time buyers will pay 5% on values between £300,001 and £500,000, and will lose their relief on prices above that.

What does this mean?

This change alone will cost first-time buyers purchasing at £400,000 with a £5,000 stamp duty bill if they complete on a purchase on the 1st April 2025 versus £0 were they to complete the day before.

Estimates show that this change will mean 20% of first-time buyers will have to pay Stamp Duty charges when they buy. Buying sooner could see you avoid being caught out by this change, and potentially save you thousands on your home purchase costs.

See what Stamp Duty you could pay

Use our Stamp Duty Calculator to see how much you may need to pay on a home purchase, whether you're a first-time buyer or moving up the ladder. Or create a free Tembo plan to discover ways you could buy sooner, or boost your affordability.

Government to invest £5 billion for house building

The Chancellor says that the Labour government will "get Britain building again", by increasing the supply of affordable housing through a £5bn investment plan. What will this look like? Well, first by increasing the Affordable Homes Programme to £3.1bn, providing £3bn worth of support and guarantees to increase the supply of homes and support small house-builders.

The Chancellor claimed these changes would give more people a "safe, secure and affordable place to live". Replenishing the housing stock will certainly help the housing affordability crisis - with more homes to buy, this means more choice for buyers - as long as the homes built are affordable. But how long will it take?

For first-time buyers, the promise of new homes being built, or planning laws being relaxed understandably holds little value. Successive governments have made big pledges to increase housing stock, yet we still have a backlog of 4.3 million homes, and any future improvements will play out over decades not months.

You might like: Are house prices rising?

Right to Buy discounts reduced

The Right to Buy discount on purchasing council homes will also be reduced in November 2024, while local authorities will be able to retain receipts from the sale of social housing so that it can be reinvested into their existing stock and create new supply. The exact reduction in discount is yet to be announced.

ISA and Lifetime ISA rules unchanged

Despite rumours of positive changes to the Lifetime ISA cap or penalty, there were no changes in the budget. This means that the property cap remains at £450,000, which has been unchanged since 2017. If the cap had risen in line with property price growth, it would be £600,000. Anyone who buys over this limit will be hit with a 25% penalty (the full 25% government bonus plus around 6.25% of your own money).

Similarly, rumours swirled that the contribution limits would change, but this didn't happen either. The annual limit remains £20,000 for ISAs and £4,000 for Lifetime ISAs (the latter included in the overall ISA limit).

Save with the market-leading Lifetime ISA

Save up to £4,000 each tax year towards your first home or retirement with a Tembo Cash Lifetime ISA. Benefit from our market-leading 4.1% AER interest rate (variable), intuitive money-saving app features and when you're ready to buy, fee-free mortgage advice.

Employers to pay more National insurance

At the minute, employers pay 13.8% in National Insurance on employees’ salaries, but the Chancellor announced that this rate would be increased by 1.2% to bring in an estimated £20bn per year. This is part of Labour’s promise to not hit workers with taxes, but the fear is that the extra costs would be passed down to staff in the form of lower pay and fewer benefits.

While this doesn’t directly impact housing, it could impact future mortgage affordability which is largely (but not solely) determined by your household income. However, remember there are ways to get a bigger mortgage.

Inheritance Tax threshold freeze extended

Currently, inheritance tax is charged at 40% on the property, possessions and money of somebody who has died above the £325,000 threshold. Britain already has one of the highest IHT rates in the OECD.

The Chancellor is extending the inheritance tax threshold freeze for a further two years to 2030. That means the first £325,000 of any estate can be inherited tax-free, rising to £500,000 if the estate includes a residence passed to direct descendants, and £1m as a couple.

Reeves claims this will mean only 6% of estates will pay inheritance tax next year, but this number could grow. The average property in the UK is just under £270,000, with the over 50s owning 78% of all property. This means there is a lot of property wealth to pass down to children and grandchildren over the next couple of decades.

There are ways for your loved ones to reduce their IHT liability, including passing on £500,000 - or £1m if they are a couple - providing they leave their home to their children.

They could also use a Deposit Boost to unlock money from their home; the proceeds would then be gifted to you to boost your own downpayment. If these funds are given to you as a gift, and your loved one lives for at least 7 years, the money won’t be taxed when they pass away. For £100,000 that they gift to you, this could potentially save your family £40,000 Inheritance Tax on their estate when they die.

Capital gains tax to rise by up to 8%

Keir Starmer ruled out charging Capital Gains Tax on someone’s first home some weeks ago (phew), but the changes announced will impact profits made from selling assets such as investments, including shares. Reeves announced that the lower rate of Capital Gains Tax will rise from 10% to 18%, and the higher rate from 20% to 24%. CGT on residential property remained unchanged at 18% and 28%, which was a relative surprise given commentary leading up to the election.

This fits neatly with their promise not to raise taxes for “working people” because it’s ultimately a tax on wealth, but it will impact higher earners. It’s unlikely to impact first-time buyers (unless you’re making annual gains of above £3,000 on other assets), but it’s not good news for landlords and property investors.

Tax treatment depends on individual circumstances and may be subject to change in the future