How is Stamp Duty changing in 2025?

Stamp Duty is increasing from 1st April 2025 for both first-time buyers and home movers. We’re here to cut through the noise and explain what this could mean for your home-buying plans.

In this guide

- What's the current threshold for Stamp Duty?

- What are the Stamp Duty changes in 2025?

- Why are Stamp Duty costs increasing?

- What impact will the Stamp Duty changes have on first-time buyers?

- What if I'm a first-time buyer but my partner isn't?

- Do I pay Stamp Duty if I sell my house and buy another?

- How to avoid paying Stamp Duty?

- How can I reduce my Stamp Duty?

- What impact could the Stamp Duty changes have on the housing market?

- Conclusion

Need help accomodating higher Stamp Duty?

Create a free Tembo recommendation to see all the ways you could boost your mortgage affordability. We'll compare your eligibility to thousands of mortgage products and budget-boosting schemes, with no credit check!

What's the current threshold for Stamp Duty?

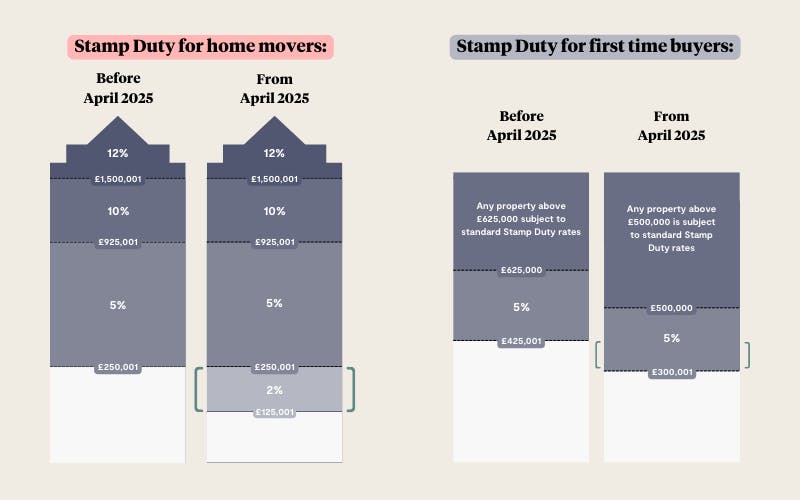

The rate of Stamp Duty tax you pay depends on the property price, and if you're a first-time buyer, home mover or purchasing a second home. Stamp Duty is broken down into bands with each band having a different rate of tax, but you only pay the tax on the portion of your property's value that's over the threshold. Right now, homebuyers in England and Northern Ireland pay Stamp Duty when they purchase a property that costs more than £125,000, or £300,000 if you're a first-time buyer.

For first-time buyers, anything over £300,000 and up to £500,000 you'll pay 5% Stamp Duty on, anything over £500,000 you'll pay the same rates as second-time buyers. For home movers (a.k.a those who aren't first-time buyers), you'll pay 2% Stamp Duty on any portion of the property value between £125,001 - £250,000 and 5% on any portion between £250,001 to £925,000.

For example, as a first-time buyer purchasing a £450,000 house, you'd pay 5% on £150,000 above the £300,000 threshold, which works out as £7,500. If you are a second-time buyer, the same property would cost you just under £12,500 in Stamp Duty.

You might also like: Stamp Duty guide for first-time buyers

What are the Stamp Duty changes in 2025?

From the 1st April 2025, the Stamp Duty threshold will drop from £425,000 to £300,000 for first-time buyers, and any properties worth over £500,000 will be subject to the same stamp duty rates as second-time buyers. For home movers, you'll have to pay 2% Stamp Duty on any property value between £125,001 - £250,000, and 5% on any of the property's value between £250,001 - £925,000.

This means more properties will fall within the taxable range - the share of first-time buyers paying the tax will jump from 21% to 42%; 83% of existing homeowners buying a new home as their main residence will pay Stamp Duty, vs 49% before.

For those purchasing second homes (such as buy-to-let properties) the Stamp Duty surcharge has increased from 3% to 5% for those in England and Northern Ireland on properties between £40,000 - 250,000 have to pay the Stamp Duty surcharge, (and has risen to 6% in Scotland).

Why are Stamp Duty costs increasing?

The government is able to generate a lot of money through Stamp Duty - so far this year, homebuyers have paid £6.6 billion in Stamp Duty tax, £100 million more than the £6.5 billion paid over the same period in 2023. Generating more money through a lower Stamp Duty threshold will help the new Labour government cover the £22bn black hole in the public finances they've accused the Conservatives of creating. However, the tax has come under criticism with calls for reform growing.

The current system is set up so you pay Stamp Duty when you purchase a home, which discourages home moving. Not only does this impact first-time buyers wanting to get on the property ladder, but also older homeowners who could downsize to smaller properties, unlocking existing family homes for the next generation.

Currently, 78% of all housing wealth is owned by the over 50s. As well as costly Stamp Duty fees, the other arguments against downsizing usually include wanting to stay in the home and community they love, as well as being in a position to host grandchildren.

But the next generation is becoming unable to afford grandkids in the first place. More than a fifth of young people are delaying having a family because of the difficulty in affording their first home. While the UK birth rate is at a record low at 1.49 children per woman, lower than those seen during the 1930s depression. Financial stability through homeownership is key for the younger generation who will be crucial in supporting an ageing population with a smaller workforce.

What impact will the Stamp Duty changes have on first-time buyers?

Now that the Stamp Duty threshold for first-time buyers has changed to £300,000, first-time buyers will face a hefty tax of £8,750 for properties costing £425,000 - the previous threshold level. This means the number of first-time buyers having to pay the tax will increase, from 21% to 42%, which could put downward pressure on house prices if demand declines as a result of more buying being unable to afford to get on the ladder.

This isn't helped by the fact that first-time buyers are buying later on in life. The average age of a first-time buyer now 33, which means there will be many buyers who have young families and will need to purchase larger, more expensive homes. First-time buyers in the South East and London will also feel the impact more, where average property prices stand at £480,108 and £536,300, respectively. It's no wonder that homes in the South East valued over £250,000 sell only once a generation – every 26 or 27 years!

What if I'm a first-time buyer but my partner isn't?

Unfortunately, as far as stamp duty is concerned you both have to be first-time buyers to qualify for stamp duty relief or benefit from the first-time buyer thresholds which are different from those for second-time buyers. There are ways to avoid this, for example you could purchase a property as a first-time buyer and your partner could be added as a Booster to the mortgage through an Income Boost - this would mean they wouldn't own the property, but their income would still be used to work out your borrowing ability.

Find out more about Income Boosts here

Do I pay Stamp Duty if I sell my house and buy another?

You do not pay Stamp Duty on your home sale, but if you buy another home, whether it's a new home to live in or a second home, you will pay Stamp Duty on the home purchase. From the 1st April 2025, home movers will have to pay 2% Stamp Duty on any home value between £125,001 - £250,000, and 5% on any of the home's value between £250,001 - £925,000.

How to avoid paying Stamp Duty?

There are certain situations where you may be exempt from paying Stamp Duty, but the criteria is quite specific, so it's best to read up on the HMRC guidance or speak to an expert. If you aren't exempt from paying Stamp Duty, there are ways to reduce what you will pay, so example by negotiating on the house price.

How can I reduce my Stamp Duty?

There are ways to soften the blow of higher Stamp Duty costs. Consider buying a cheaper property to stay under the new threshold or negotiating on price could help reduce how much you'll pay. Taking out a longer mortgage can also help to make mortgage payments more affordable, helping you to accommodate the Stamp Duty costs. Mortgages with 30, 35 and 40-year terms are becoming increasingly common. But keep in mind that while your monthly costs will be more affordable with a longer mortgage, in the long run you’ll pay more interest to your lender.

Another option is to consider purchasing through shared ownership. These part buy, part rent schemes let you purchase a share of a property, and then rent the rest. Over time, you can purchase more of the home until you have full ownership. Because you are only purchasing a portion of the property, you should only pay Stamp Duty on that portion. Just make sure you are buying through an approved shared ownership scheme!

Read our guide: Is it better to pick a longer mortgage?

You might also like: How to reduce Stamp Duty costs

What impact could the Stamp Duty changes have on the housing market?

With the lowered thresholds, many home buyers will find themselves paying more in Stamp Duty. This makes the already challenging task of saving for a deposit even harder and could cause some would-be buyers to hold off purchasing to raise the additional funds needed. It already takes 10 years to save up a deposit on average, the additional Stamp Duty costs could set aspiring homeowners time to buy back even further.

The new Labour government's ambitious housing plan to build 1.5 million new homes within five years is a step towards addressing the housing shortage. However, the reduced Stamp Duty threshold might counteract these efforts. The average new build home costs £413,000, just under the current Stamp Duty threshold for newbie buyers. Now the threshold is lowered, the average new build home would cost £5,650 in Stamp Duty costs!

Plus, by increasing the tax burden the government could potentially slow down the housing market, as fewer people can afford to buy or move home. We're only just seeing the market begin to bounce back. Higher mortgage rates have taken a toll on affordability; over the last five years, the average mortgage payment for first-time buyers has risen by 61% to £1,075 a month, while average wages have only grown by just 27% over the same period.

There are alternative ways that the government could reduce the burden on homebuyers without it being too costly for the Treasury. The Stamp Duty holiday in 2020 and 2021 showed that homebuyers could get Stamp Duty relief while tax revenue stayed strong - in fact, this period saw increased housing market activity, showing how lower taxes can stimulate the market.

Another option is to scrap Stamp Duty completely.

There have been growing calls for Chancellor Rachel Reeves to abolish the trio of property taxes - council tax, stamp duty and business rates - and replace it instead with a land tax.

The current council tax system is outdated, based on property valuations from 1991 and adds to major regional inequalities. In Westminster, one of the richest boroughs in the country, the annual council tax bill for a typical home is £973, while in Hartlepool, homeowners in the equivalent tax band are charged £2,278.

While business rates are a land-based tax for businesses that have also been criticised for being out of date and not reflecting the new normal of online shopping.

The proposal is to scrap all three. The new land tax would be based on the value of people’s land, and potentially the buildings on it, hitting wealthy landowners and property moguls hardest. So far this idea has had wide support, with the Campaign group Fairer Share planning to send a joint letter from cross-party MPs. If acted, this reform could make it easier and cheaper to move house to downsize, move jobs, or to be near family.

Conclusion

These new changes to Stamp Duty are set to make a significant impact on the housing market, particularly for first-time buyers. While the government's intention is to generate more revenue, the increased costs could deter new buyers. For those looking to enter the market, understanding these changes and planning accordingly will be key.

If you're feeling uncertain about how these changes affect you, you're in the right place. At Tembo, we specialise in helping the next generation onto the property ladder through a range of budget-boosting schemes and initiatives. We've already helped thousands discover their true mortgage affordability. In fact, on average we boost budgets by £88,000. Get started here

Start your journey to homeownership today

Create your own personalised mortgage recommendation today to see how you could buy sooner or boost your budget. You'll see all of the ways you could make home happen including indicative interest rates and monthly costs. You can also book a free, no-obligation call with one of our award-winning mortgage experts.