How to calculate interest

Anya Gair

Anya GairIf you’re saving to buy your first home or saving up for a big life goal, it’s good to know how to calculate interest on your savings and mortgage. This can help you work out how hard your savings are working for you, or if you could afford a new mortgage deal with a different interest rate.

In this guide

- What are the different types of interest rates?

- How to calculate savings interest

- What is simple interest?

- What is compound interest?

- How to calculate compound interest

- How to calculate mortgage interest

- What is accrued interest?

- What is a real interest rate?

- Should I choose a fixed-rate or variable interest rate?

- When do interest rates change?

- How to earn more interest in a savings account

What are the different types of interest rates?

There are two main types of interest rates you’ll see across financial products, including savings and mortgages: fixed and variable. A fixed-rate will stay the same for a set period of time, meaning your interest rate won’t change until the fixed period is over. A variable rate can rise and fall over time, reflecting what is happening to current interest rates available on the market.

There are other terms you might hear around interest rates, like simple interest rate, compound interest rate, real interest rate and accrued interest. We’ll explore these below.

How to calculate savings interest

To figure out how much interest you’ll earn on your savings, you can use this basic formula:

Principal x Rate x Time = Interest

Here’s what each term means:

Principal: The amount of money you’re starting with

Rate: Interest rate, expressed as a decimal. For example, 1% becomes 0.01.

Time: Length of time period, usually one year

Interest: The amount of interest you’ll earn

For example, if you have £1,000 in a savings account earning 1% interest each year, you can calculate the interest like this:

£1,000 x 0.01 x 1 = £10

This means you’ll earn £10 in interest after one year.

What is simple interest?

Simple interest is a quick way to calculate interest. You work out simple interest by multiplying the interest rate by the amount that is borrowed or saved, then multiply this by the number of periods (usually years) the money is saved or lent for. For example, if you saved £50 for 3 years, and had an interest rate of 5%, you would first work out 5% of £50 by multiplying 50 by 0.05 to get £2.50. Then, you would multiply £2.50 by 3 to get £7.50, which is the amount of interest you’d earn over the 3 years.

What is compound interest?

Compound interest is the interest you earn on both your original deposit and the interest that has already been added to it. Compound interest helps your savings grow over time, even if you don’t make any additional contributions of your own.

Learn more: How much should I have in savings?

How to calculate compound interest

Calculating long-term compound interest requires more complex formulas. It can be quicker and easier to use an online compound interest calculator.

For the sake of simplicity, let’s imagine you have a savings account that pays you 5% interest every month. If you place £1,000 in this savings account, you’ll earn £50 in interest at the end of the first month. This brings your total balance to £1,050. At the end of the second month, you’ll earn 5% interest on the new balance, giving you an extra £52.50. This brings your total balance to £1,102.50. You would then continue to earn 5% interest on the new balance each month, effectively earning interest on interest.

Get the market-leading interest rate on your house savings

Save up to £4,000 each year in our Cash Lifetime ISA and you’ll benefit from our market-leading 3.8% AER interest rate, plus the free 25% government bonus!

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

How to calculate mortgage interest

Your mortgage interest rate is worked out as a percentage of your outstanding mortgage debt. This is why over time you pay less in interest, as your mortgage debt gets smaller. To quickly calculate how much mortgage interest you pay take the current outstanding balance of your mortgage and multiply the number by your current interest rate as a decimal (for example, 4% = 0.04). Then divide that number by 12 to see how much mortgage interest you’ll pay on your next mortgage payment.

For example, let’s say you have £220,000 left on your mortgage and your interest rate is 4%. You would multiply £200,000 by 0.04% to get £8,800. You can then divide this figure by 12 to get £733.33. This means you’ll pay £733.33 interest on your mortgage on your next monthly repayment.

If you have an interest-only mortgage, this is all you’ll pay. If you have a repayment mortgage, your monthly payments will be higher as you’ll also have to repay the capital.

Top tip

To make sure you’re getting the best interest rate for you, it’s always worth speaking to a mortgage broker like us. We have access to thousands of mortgage deals, including ones that aren’t commercially available, which means you could end up saving a lot of money!

Compare the best mortgage rates

Find the right mortgage for you with our comparison tool. Simply tell us your deposit size, mortgage type and property value, and we’ll compare over 20,000 mortgage products from over 100 lenders.

The interest rates shown are an indication only and are not guaranteed. Current rates may have changed by the time you come to apply.

What is accrued interest?

Accrued interest is the amount of interest on a debt like a bond, or a savings account that has built up over time. For example, you might have a savings account where the interest on your balance is accrued daily but is credited to your account at the end of the month - this is sometimes called your interest balance.

What is a real interest rate?

A real interest rate is when the projected rate of inflation is added to your interest rate to give an insight into the actual return you could receive on your savings or investments. Having your savings in an account with an interest rate above the current rate of inflation can help protect the value of your savings from diminishing over time.

Should I choose a fixed-rate or variable interest rate?

Fixed interest rates on a mortgage can provide you with protection from rising interest rates, as your rate will stay the same even if current rates increase. The opposite is true if live interest rates fall, as your fixed mortgage interest rate could end up being higher than what’s currently available on the market. Fixed interest rates on savings accounts like ISAs offer protection from falling interest rates, as no matter what happens to the market as a whole, your interest rate will stay the same. If rates do drop, this means your interest rate will be higher than current rates, helping to boost your savings. But if rates rise, this could mean your savings interest rate is lower than what is currently available on the market.

When do interest rates change?

Your interest rate will usually be influenced by the Bank of England’s base rate, as well as other market factors like swap rates. However, your bank or mortgage lender can increase or decrease your rate independently from these external factors.

Find out more: Are interest rates going up?

You might also like: Best Cash ISAs in the UK right now.

How to earn more interest in a savings account

Here are three ways to earn more interest on your savings.

1. Choose an account with a competitive rate

Different accounts come with different interest rates, so it’s worth shopping around to see if you could get a better deal elsewhere. Smaller banks tend to offer higher interest rates than the familiar high-street names - for example, the Tembo Cash ISA has an interest rate that's 2.7x higher than those offered by the UK's four biggest banks! Fixed-term accounts also tend to offer better rates than easy access ones, but remember you are agreeing to keep your money in the account for a fixed time period.

To learn more about how tax on savings interest works, take a look at our guide: Do you pay tax on savings interest in the UK?

2. Saving for your first home? Use a Lifetime ISA

If you’re a first-time buyer, a Lifetime ISA (LISA) can be even more rewarding than a traditional Cash ISA. Save up to £4,000 a year in your LISA and you’ll get a 25% bonus from the government up to a maximum of £1,000 each tax year. So not only will you earn tax-free interest on your own contributions, you’ll earn it on the government’s contributions too!

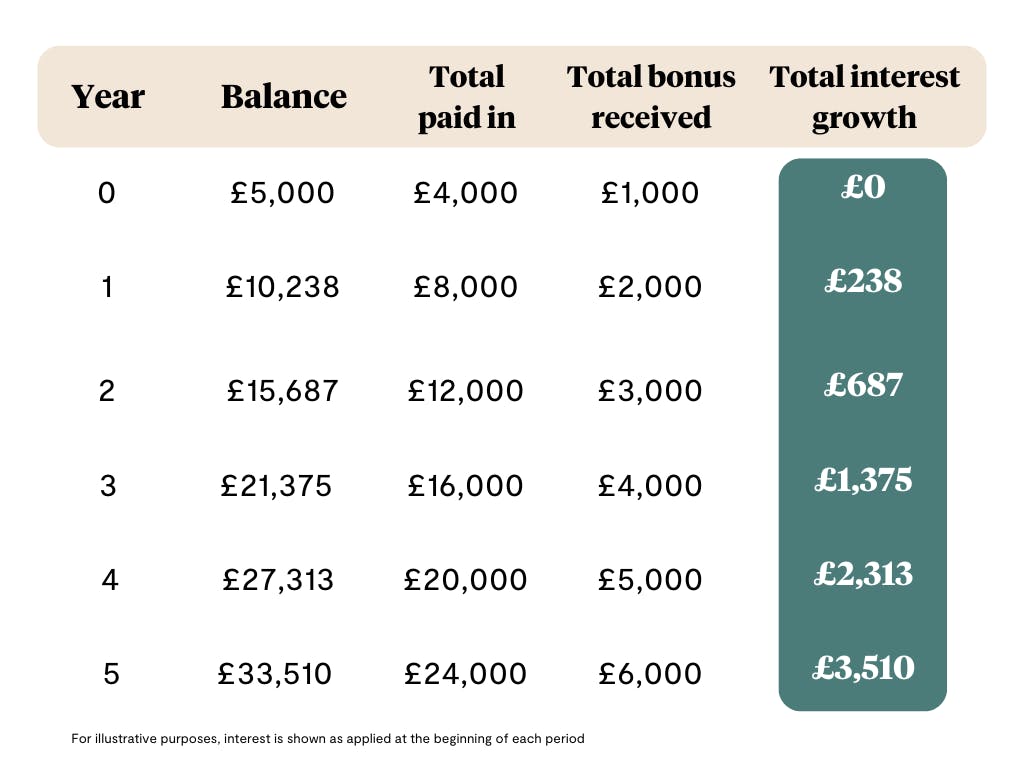

Let’s take a look at how your savings could grow, if you max out your LISA at the start of the year for 5 years in a row, and have your money in a Tembo Cash LISA earning our market-leading 3.8% AER (variable) interest rate:

3. Save as soon as possible

The sooner you add money to your account, the sooner you’ll earn interest and the more time your money has to grow.

If you have a Tembo Lifetime ISA, for example, you’ll earn more interest if you place the full £4,000 in your LISA as soon as you open your account. The 25% government bonus will be added to your LISA within a matter of weeks, meaning you’ll earn interest on £5,000 rather than £4,000. You’ll need to wait until the following tax year to add more money, but your LISA savings will continue to earn compound interest in the meantime.

Of course, if you’re at the start of your deposit saving journey and you can only afford to contribute a small amount each month, that’s okay too. You’ll still get the 25% bonus and earn interest, but your savings won’t grow quite as quickly.

Start earning tax-free interest today - and boost your savings by 25%!

You can buy your first home faster with the help of a Tembo Cash Lifetime ISA. Save up to £4,000 a year and you’ll get up to £1,000 free from the government, plus our market-leading interest rate. Join the thousands of others already saving by downloading the app today.