Can you add Stamp Duty to a mortgage?

Stamp Duty Land Tax (SDLT) rates have changed this year, making it that little bit more expensive to buy a home in England or Northern Ireland for some. For home buyers hoping to get on the ladder or move up it, this news could put a spanner in the works if you need to cover a higher Stamp Duty bill than you were expecting. You can’t put Stamp Duty on a credit card or spread the cost with regular instalments, but can you add Stamp Duty to your mortgage? If you’re hoping to buy a house in 2025 and you’re worried about the costs, here’s what you need to know.

Good to know

Stamp Duty Tax is called different things in different parts of the UK. In England and Northern Ireland, it's known as Stamp Duty Land Tax. Scotland calls it Land and Building Transaction Tax, and in Wales, it’s known as Land Transaction Tax.

Can you pay Stamp Duty in instalments?

No, you unfortunately can’t pay Stamp Duty in instalments or spread the cost with a credit card. You must pay your Stamp Duty bill within 14 days of buying a property, or pay a penalty to HMRC.

Can you add Stamp Duty to your mortgage?

Yes, it’s possible to add Stamp Duty to your mortgage. But this means you’ll need to take out a bigger loan to cover both your property purchase and your Stamp Duty charge. Since you’ll be borrowing a larger sum, your mortgage payments will increase and you’ll pay more interest over the course of your mortgage term. Adding Stamp Duty to your mortgage will also result in a bigger loan-to-value ratio (LTV), which could affect the interest rate you’ll be offered.

Need help accomodating higher Stamp Duty?

Create a free Tembo recommendation to see all the ways you could boost your mortgage affordability. We'll compare your eligibility to thousands of mortgage products and budget-boosting schemes, with no credit check!

When is the Stamp Duty paid?

You need to pay Stamp Duty within 14 days of buying a property or piece of land. If you’re using a conveyancer or solicitor, they’ll usually make the payment for you. In some cases, you may not need to pay any Stamp Duty at all.

Is Stamp Duty increasing?

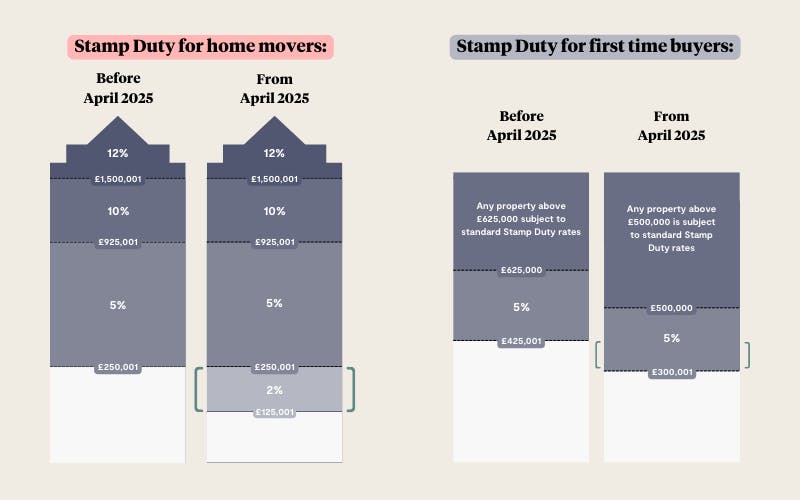

Yes, the thresholds for paying Stamp Duty on home purchases dropped on 1st April 2025, which means that more buyers will have to pay Stamp Duty or have a higher tax bill to pay. For first-time buyers, the threshold after which you’ll be liable for Stamp Duty dropped from £425,000 to £300,000, and anything over £500,000 will be subject to standard Stamp Duty rates. For those moving up the ladder, the threshold for paying Stamp Duty dropped from £250,000 to £125,000.

You can find a full breakdown in our How Stamp Duty is changing in 2025 guide, or take a look at the image below to compare the previous Stamp Duty rates with the new charges from April.

Perfect for you: First-time buyer guide to Stamp Duty

What happens if you can’t pay Stamp Duty?

If you can’t pay Stamp Duty within 14 days of buying a property, you may have to pay a penalty. HMRC will also charge you interest daily until you pay the money. The interest will be based on the official rate of interest set by HM Treasury and you cannot appeal against these interest charges.

When is Stamp Duty not payable?

If you’re not a first-time buyer, no Stamp Duty will be payable if you’re buying a residential property worth less than £125,000 in England, Northern Ireland. First-time buyers currently pay no Stamp Duty when buying a home worth up to £300,000.

If a loved one is giving you a property as a gift, you usually won’t have to pay Stamp Duty as long as there’s no outstanding mortgage on the property. You usually won’t have to pay Stamp Duty on a property you inherit, even if you’re taking on the mortgage of the person who passed away. There’s no need to submit a Stamp Duty return, but you will need to inform HMRC and in some cases, you may have to pay inheritance tax.

Take a look at our inheritance tax guide to learn more

Learn more: What are the benefits of an early inheritance?

What is the loophole for Stamp Duty?

There are a few legal ways to reduce the amount of Stamp Duty you pay. These include negotiating with the home seller to reduce the property price - particularly if the property is currently priced just above a particular threshold - as well as paying for fittings and furnishings separately. Buying a home with high-quality fixtures and fittings included may be convenient, but it can result in a bigger Stamp Duty bill. Kitchen units, cupboards, sinks, wall-mounted ovens, and central heating systems are just a few examples of fittings that can add to the property’s value and cost more in tax. If the seller is unwilling to budge on the property price, you could ask them to take certain removable fittings with them or pay for these separately from the property price.

If you’re buying a new build, ask the home developer if they’ll pay your Stamp Duty bill for you. There’s no guarantee they’ll say yes, but it’s worth a try.

If you’re buying a house with your partner, you’ll both need to be first-time buyers to qualify for first-time buyer Stamp Duty relief. If you’re buying with someone who is a second-time buyer, you could add them as a guarantor on the mortgage instead of a buyer through an Income Boost! An Income Boost is designed to help first-time buyers get on the property ladder by adding a friend or family member’s income to the mortgage application. It’s particularly useful for single people looking to buy a home with their parents’ help, but couples can use it to reduce their Stamp Duty bill without getting their Mum, Grandad or generous rich Auntie involved.

So how will this work for you? Well, instead of buying the house together as joint owners, the second-time buyer will act as the first-time buyer’s guarantor. Something to consider is that although the second-time buyer will be named on the mortgage, they won’t be named on the property deeds. They also won’t have to contribute towards the monthly payments or the house deposit, unless the first-time buyer is unable to pay these costs themselves.

Find out more about Income Boosts here

Another possible way to save on Stamp Duty is through a Deposit Loan. Here, the second-time buyer will contribute towards the house deposit in return for a share of the home. Although they’ll have an equity stake in the property, they won’t be classed as a joint owner and that first-time buyer Stamp Duty relief will be protected.

Discover how you could buy sooner

Create a free Tembo plan and uncover all the budget-boosting schemes within your reach. On average our customers increase their homebuying budget by £88,000. See what you could afford today.