What is the lowest LTV on a mortgage?

How does LTV work, how does it affect your ability to buy a house and what’s the lowest LTV on a mortgage you can get? Find out everything you need to know about LTVs here.

What is LTV?

LTV stands for Loan to Value, it’s a percentage that represents the size of your mortgage compared to the value of the property. So, if you’re buying a house worth £300,000 with a £60,000 deposit and a £240,000 mortgage, your deposit is 20% of the property’s price, which means your LTV is 80%.

How does LTV work?

LTV gives mortgage lenders an easy way to assess the amount of risk involved when offering a particular loan. It plays a key part in lenders’ mortgage affordability checks when they look at your income, credit rating and expenses to make sure the loan is affordable. A higher LTV means you’re borrowing a larger percentage of the property’s value for a mortgage. This is riskier for lenders, so you’ll usually be offered a higher interest rate. A low LTV means you’ve saved a larger deposit or have built up a large amount of equity in your home over time. As low LTV mortgages are less risky, lenders often reward these borrowers with more competitive interest rates.

How to calculate LTV

To calculate an LTV, simply divide the property’s value by the mortgage amount and multiply it by 100.

LTV ratio = Mortgage Amount / Property Value x 100

Here’s how these figures would work if you’re buying a £500,000 property with a £50,000 deposit and £450,000 mortgage:

£450,000 / £500,000 x 100 = 90% LTV

Is there a minimum LTV?

Technically, there’s no minimum LTV rules that all lenders must follow. If you’re eligible for a 100% mortgage, it’s possible to buy a house with no deposit. However, individual lenders will set their own criteria and will usually have guidelines outlining the minimum and maximum LTV they’re willing to offer. Most lenders prefer borrowers to have a deposit of at least 10%, meaning the maximum LTV is usually 90%. If you’re struggling to save a 10% deposit, it may be possible to get a 95% LTV mortgage (5% deposit). To qualify, you’ll usually need an excellent credit history, a good income, and sometimes a guarantor.

The lower your Loan to Value of 80%, the better interest rates you’ll usually have access to. This can make your monthly payments more affordable and reduce the amount you spend on your mortgage overall, as well as reducing the size of your debt.

Learn more: How to buy a house with a small deposit

Discover how you could boost your buying budget

We’ve helped hundreds of people discover how they could increase their affordability and get a mortgage with the help of specialist schemes. Find out how much you can borrow by registering today.

What is the lowest LTV on a mortgage?

The lowest LTV on a mortgage is technically less than 1%, as these are borrowers who’ve almost finished paying their mortgages off. But if you’re looking to take out a new mortgage or remortgage, you may be able to find 50% and 40% LTV mortgages but 60% LTV is typically the lowest LTV offered by lenders.

Most lenders also have a minimum amount they’re willing to lend. For example, Nationwide’s minimum mortgage size is £25,000, while Barclays’ minimum loan size on residential mortgages is much lower at £5,000. Earlier this year Halifax’s minimum mortgage amount for 2 to 5-year products increased from £25,000 to £100,000 through selected brokers.

Who is eligible for low LTV ratios?

You may be eligible for a mortgage with a low LTV ratio if you have a deposit equivalent to 20% of the property price or more, as mortgages with an LTV of 80% are usually considered low. However, a big deposit doesn’t guarantee you a mortgage. You’ll still need to meet the lender’s affordability criteria. Your income, credit score and even your current living expenses will also be considered as part of your mortgage application.

How to reduce your LTV ratio

To reduce your LTV ratio, you’ll usually need to choose a cheaper property or save a larger deposit. For example, let’s imagine you’ve saved a £10,000 deposit and you’re hoping to buy a £200,000 house - that means your LTV will be 95% (5% deposit). If you are able to put down £20,0000 as a deposit, your LTV will drop to 90% (10% deposit). If you go for a cheaper property worth £100,000 with the same £20,000 deposit, your LTV will be 80% (20% deposit).

Remember that LTV is grouped into brackets - normally 95%, 90%, 80%, 75% etc.) If you’re in between two brackets, you’ll likely be offered rates at the higher LTV. So if your actual LTV is 93%, you’ll be offered rates from the 95% LTV bracket, not the 90% bracket.

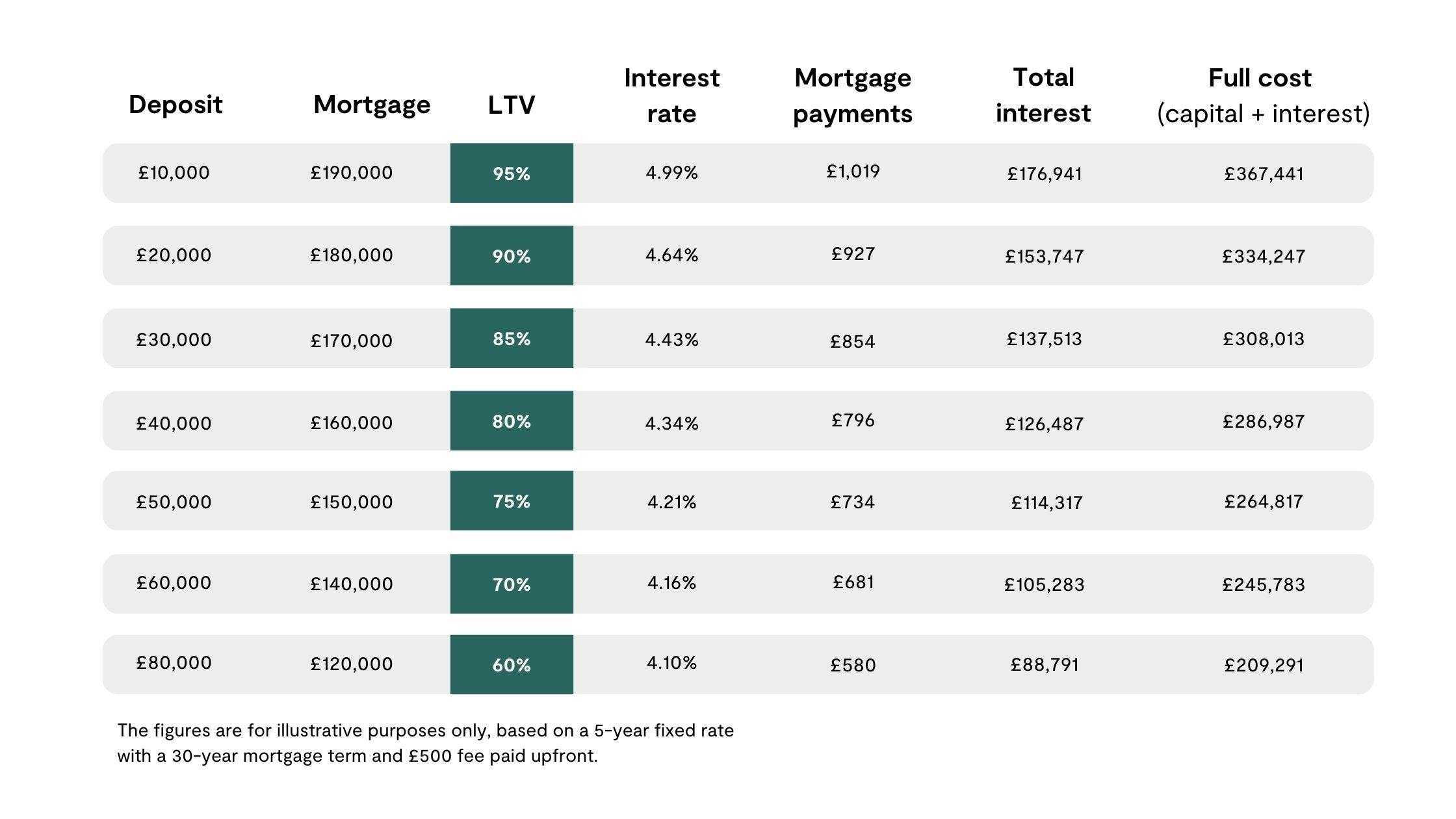

Take a look at the table below to see how a lower LTV can impact what interest rate you’ll be offered, and therefore your mortgage payments, the amount of interest payable and the full cost of your mortgage.

Save faster with the market-leading Cash Lifetime ISA

Save up to £4,000 per tax year in our Cash Lifetime ISA and earn a market-leading 4.33% AER interest rate (variable). Plus, get a 25% government bonus of up to £1,000 per tax year to boost your first home deposit or retirement pot. Download our app and start by adding just £1.

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.