Best Lifetime ISA providers in the UK

If you’re a first-time buyer, opening a Lifetime ISA could help you reach your savings goals faster. You can save up to £4,000 a year in it and the government will top it up by 25% — that’s a bonus of up to £1,000 a year. But you can also earn interest or investment growth on top - depending on whether you go for a Cash Lifetime ISA or Stocks and Shares Lifetime ISA. But which provider do you choose to go with? Keep reading to find out the best Lifetime ISA providers in the UK below.

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in. Tax treatment depends on individual circumstances and may be subject to change in the future. Capital at risk when investing, past performance is not a reliable indicator of future results.

Open our ✨market-leading✨ Lifetime ISA today

Save up to £4,000 each tax year and get a free 25% bonus on top of your savings, up to £1,000. Plus, with the Tembo Cash Lifetime ISA, you'll earn 4.1% AER (variable) on your savings - that's hundreds more in interest towards your house fund vs saving with the closest competitor!

What is a Lifetime ISA?

A Lifetime ISA is a special type of ISA savings account available to those aged 18-39 that lets you save up to £4,000 each tax year towards your first home or retirement. Each tax year you save into the account the government will boost your contributions by 25% for free, up to £1,000. You can choose a Cash Lifetime ISA, where your savings will benefit from interest growth, or a Stocks and Shares Lifetime ISA, where your funds will be invested in the stock market.

How does a Lifetime ISA work?

For every £4 you save into a Lifetime ISA, you get a free £1 off the government, up to £1,000 each tax year! The bonus is paid every year you pay into your Lifetime ISA, and is paid monthly (although it can take 4-6 weeks to land in your account).

The money in your LISA must be used for your deposit for your first home purchase, or to fund your retirement - any withdrawals for other purposes will incur a 25% withdrawal charge, which means you could get back less than you put in. If you use your LISA for a home purchase, the property you're buying must be worth £450,000 or less, and be your first home anywhere (including if you've bought or part-owned a property abroad).

Who has the best Lifetime ISA?

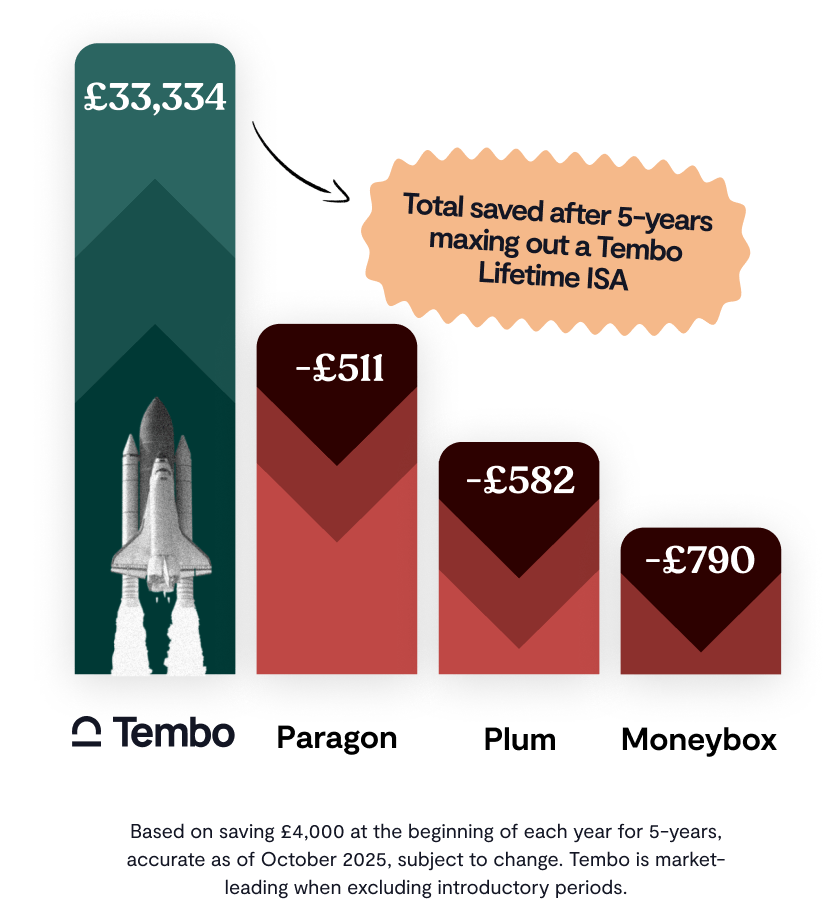

When it comes to who has the best Lifetime ISA, it's a good idea to think long-term. Excluding introductory teaser rates, Tembo offers the market-leading Cash Lifetime ISA rate at 4.1% AER (variable). Saving up for your first home or retirement often takes years, and although introductory teaser rates might seem appealing, you might forget to switch down the road.

This isn't uncommon, we're creatures of habit - over a third of us have had the same current account for over 20 years.

This is why at Tembo, we offer our market-leading 4.1% AER (variable) rate to new customers, transferring customers and existing customers 👏

Who offers Lifetime ISAs?

There are a range of banks and savings providers that offer Lifetime ISAs including Tembo, but not all banks and building societies offer it as a product. Instead of looking to see if your local high street bank offers a Lifetime ISA, look at who offers the best Lifetime ISA rate instead. This may be a digital bank or a newer savings provider as opposed to an older bank. Saving with a high interest rate can help your Lifetime ISA savings grow by hundreds compared to saving with another provider.

The below list is based on UK Lifetime ISA accounts providing the highest rate of interest or best service for first-time buyers or retirement savers.

Best Cash Lifetime ISA providers:

If you’re using the Lifetime ISA for a house purchase in the next few years, a Cash LISA is likely to be the best option. The government will top up your contributions by 25%, and you’ll also benefit from interest gains. This is why choosing a Lifetime ISA provider with the best interest rate can have a significant impact on your house fund value. For example, by saving with Tembo you'll benefit from hundreds more in interest vs saving with the closest competitor on the market.

Here are the top Cash Lifetime ISA providers in the UK to choose from:

1. Tembo

The Tembo Cash Lifetime ISA offers the market-leading rate at 4.1% AER (variable). Over 5-years, that means hundreds more added to your savings pot if you save with us vs the best next rate on the market.

As well as our market-leading rate, our intuitive app will also show you your time to save, not to mention tips and guidance to reduce that timeframe. Tembo savers can also access our award-winning mortgage service fee-free, helping you to discover ways you could buy sooner or increase your budget - on average, our customers boost their mortgage affordability by £88,000!

What’s the interest rate? 4.1% AER (variable)

How do you open an account? App

How do you manage your account? App

When is the interest paid? Monthly

Can you transfer from other ISAs? Only from existing LISAs, not ISAs

2. Paragon

What’s the interest rate? 3.51% gross/AER variable rate

How do you open an account? Online

How do you manage your account? Online, by post or phone.

When is the interest paid? Annually

Can you transfer from other ISAs? Yes but only other LISAs

3. Plum

What’s the interest rate? 4.25% gross/AER variable rate, dropping to 3.36% after 12 months

How do you open an account? App

How do you manage your account? App

When is the interest paid? Monthly

Can you transfer from other ISAs? Yes but only other LISAs

4. Moneybox

What’s the interest rate? 4.8% gross/AER variable rate, dropping to 3.05% after 12 months

How do you open an account? App

How do you manage your account? App

When is the interest paid? Monthly

Can you transfer from other ISAs? Yes but only other LISAs

3. Bath Building Society

What’s the interest rate? 3.34% tax-free pa/AER variable

How do you open an account? Online or branch

How do you manage your account? Online or branch

When is the interest paid? Annually

Can you transfer from other ISAs? No

Worried your LISA savings aren't enough?

Our award-winning team are experts at helping first-time buyers discover their true buying budget. Working with over 100 mortgage lenders and specialist schemes we can recommend the best options for your situation to boost your mortgage affordability.

Using a Lifetime ISA for retirement?

By saving into a Lifetime ISA instead of enrolling in or contributing to a pension, you may lose out on contributions by an employer (if any), and it may affect your entitlement to means-tested benefits.

Best Stocks & Shares Lifetime ISA providers

If you’re using the Lifetime ISA for retirement, or are not planning to buy a home soon, a Stocks and Shares LISA may be more suitable than a Cash LISA. Not only will the government top up your contributions by 25%, you’ll also benefit from investment growth — which historically has outperformed savings interest in the long term. However, the value of your investments can go down as well as up and you may get back less than you originally invested.

Here are some of the top Stocks and Shares Lifetime ISA providers in the UK at the moment:

1. Tembo

Unlike other Stocks and Shares Lifetime ISA providers, Tembo doesn’t charge a monthly fee. Instead, you’ll pay a 0.35% platform fee and a 0.17% fund provider fee. Your money would also be invested in the Blackrock MyMap 5 Select ESG fund, which is an ESG fund - ESG stands for environmental, social and governance, meaning it's a collection of "ethical" investments designed to have a positive impact. While you might think the ESG funds might not perform as well as other funds, this isn't necessarily the case - the Blackrock MyMap 5 Select ESG fund delivered a total return of 12.3% in 2023!

Cost: 0.35%

Average annual fund cost: 0.17%. Additional fees charged by the fund provider BlackRock.

How to manage: App

Minimum investment: £25, but we recommend to save as much as you can. While low balances will still benefit from interest with a Cash LISA, Stocks and Shares LISAs are subject to an annual management fee which is applied monthly.

2. AJ Bell

AJ Bell is one of the UK’s largest investment platforms, with over 540,000 customers. Its Lifetime ISA may be ideal if you’d like a wide choice of investment funds. But with a high initial investment of either a £500 lump sum or £25 a month, it might not be suitable if you only want to invest small amounts.

Cost: 0.25% custody charge (maximum £3.50 a month for shares)

Fees to buy/sell funds: £1.50

Fees to buy/sell shares: £9.95 (or £4.95 if you made 10 or more share deals in the previous month)

How to manage: Online/app

Minimum investment: £250 lump sum/£25 a month

3. Hargreaves Lansdown

Hargreaves Lansdown is a FTSE 100 company, managing more than £120 billion for 1.7 million clients. When you open a Hargreaves Lansdown LISA, you can choose your own investments or pick one from its ready-made portfolios. You can add money to your LISA with a monthly Direct Debit, making it easier to grow your savings without having to think about it. If you don’t know what to invest in, you can add cash to your LISA now, then decide where to invest later on.

Cost: This depends on whether you hold funds or shares. For shares, there’s a 0.25% annual management charge (capped at £45 a year). For funds, 0.45% on the first £250,000, 0.25% for the value between £250,000-£1m, 0.1% on the value between £1m-£2m and no charge on anything over £2m.

Fees to buy/sell funds: None

Fees to buy/sell shares: Between £5.95 and £11.95

How to manage: Online/app

Minimum investment: £100 to open the account. £25 minimum for monthly payments.

Perfect for you: Should I buy a house?

4. Moneybox

With Moneybox, you can choose from three simple Starting Options, or customise your portfolio with top US stocks, funds, and ETFs.

Cost: £1 per month subscription fee & 0.45% platform fee (charged monthly)

Fees to buy/sell funds: None

Fees to buy/sell shares: None

How to manage: Online

Minimum investment: £1

5. Nutmeg

Nutmeg is an online investment management service with a range of investment products including LISAs, ISAs, pensions, and general investment accounts. Nutmeg is the largest digital wealth manager in the UK with 200,000 clients. It believes investing should be a “clear and straightforward” experience, with its website promising transparency and easy access to performance metrics.

It offers a fully managed service where your portfolio will be managed for you, but this comes with an annual charge of 0.75%. Alternatively, you may choose a fixed allocation portfolio with a smaller fee of 0.45%.

Cost: Annual costs depends on the fund chosen

Average annual fund cost: 0.17% to 0.32%

How to manage: Online/app

Minimum investment: £100

So, where is the best place to get a Lifetime ISA?

When it comes to saving into a Cash Lifetime ISA, Tembo is the best bet - over 5 years our market-leading 4.1% AER (variable) interest rate will increase your LISA savings by hundreds in interest alone vs the closest rate on the market. When it comes to a Stocks and Shares Lifetime ISA, this really depends on how much flexibility you want in choosing where your money is invested.

Providers like AJ Bell and Hargreaves Landsdown are older names with a wide choice of investment funds, but they have higher required amounts to open accounts with them. If you want to choose a provider that chooses the fund for you knowing you are investing ethically and have a lower minimum opening balance, our Stocks and Shares LISA could be a good option.

Is it too late to open a Lifetime ISA?

If you're aged between 18-39, it's not too late to open a Lifetime ISA and use it to save up for your first home, or retirement. Remember that you must have the account open for 12 months before you use it to purchase your first home. If you want to use a LISA to save for retirement, make sure to open the account before the cut-off age. You can keep paying into your LISA until your 50th birthday, and your funds will continue to earn interest or investment growth until you take your savings out once you're 60 or over.

What are the disadvantages of a Lifetime ISA?

One of the main disadvantages of a Lifetime ISA is the age restrictions - you must be aged between 18 and 39 to open a LISA. You must have the account open for at least 12 months before using it to purchase your first home, and if you're saving for retirement you can't access your funds until you're at least 60. The other main disadvantage of a Lifetime ISA is the withdrawal penalty - if you withdraw your money from your LISA for any reason apart from buying your first home or funding retirement, you'll incur a 25% withdrawal charge, which could mean you'll get back than you put in. If you're using a LISA to purchase a property, the property you're buying must be worth £450,000 or less, be in the UK and you must use a residential mortgage to purchase it.

If you want to save your money in an ISA but a Lifetime ISA isn't the right fit, consider a Cash ISA instead! You can save up to £20,000 each tax year tax-free and use the funds for anything (not just your first house or retirement like with a Lifetime ISA). Plus, with a Tembo Cash ISA, you'll earn 2.7x more interest than if you were to save with one of the UK's Big Four banks!* You'll also benefit from unlimited withdrawals, and fee-free access to our award-winning mortgage service. Get started here

Struggling to save up enough?

With costs of living going up and earnings remaining fairly flat, it’s unsurprising that one of the most common reasons we see for people being unable to get a mortgage is due to being unable to put money aside to save up a large enough deposit. Thankfully, we’re here to help. At Tembo, we work with over 100 lenders and specialist buying schemes to help the next generation get on the property ladder. These include guarantor mortgage options including a gifted Deposit Boost and family springboard mortgages.

And don’t worry if your family isn't in a position to help you. There are other options including joint mortgages with friends or siblings, shared ownership and 5.5x Mortgages.

So whether you’re ready to buy or you’re wondering what your options could be, create a free plan with us today. On our homebuyer platform, our bespoke technology analyses your eligibility for specialist schemes from over 100 mortgage lenders to create a personalised recommendation just for you.

You might also like: How to buy a home with a low deposit

Discover your true house buying budget with Tembo

We specialise in helping home buyers to bridge the mortgage affordability gap with our smart decisioning technology. To find out how much you could borrow with our help, create a plan today on our homebuyer platform. It's free, takes 10 minutes to complete and there's no credit check involved.

Learn more

*Based on saving £100 at the beginning of each month for 5-years. Calculations show at month 61 (after 5-years) Tembo customers saving at 4.10% would have £448.69 on average more than saving with Barclays, HSBC, NatWest or Lloyds. Accurate October 2025.