Do First Time Buyers pay Stamp Duty and how much is it?

When you’re saving to buy a house, your deposit can seem the only financial obstacle standing between you and your dream home. But once you’ve got 5%, 10% or 20% of the property price tucked away in a savings account or Lifetime ISA, it’s time to start thinking about fees and taxes too. In this guide, we'll run over what Stamp Duty is, whether first-time buyers pay Stamp Duty and how much you'll pay.

In this guide

- What is Stamp Duty?

- How is Stamp Duty calculated?

- Do first time buyers pay Stamp Duty?

- How much is Stamp Duty for first time buyers?

- What happens if I’m a first-time buyer buying with a homeowner?

- When do you pay Stamp Duty?

- Can I get first time buyer Stamp Duty relief if I’m using a guarantor mortgage?

- Can I get first time buyer Stamp Duty relief if buying a shared ownership property?

- Can I use my Lifetime ISA bonus to pay my Stamp Duty?

What is Stamp Duty?

Stamp Duty Land Tax (SDLT or Stamp Duty for short) is a tax paid to the government when you buy property or land in England and Northern Ireland - Wales and Scotland have similar property taxes that have slightly different names. The Stamp Duty tax is broken down into bands and each band triggers a different rate of tax. The more expensive the property’s price tag, the bigger the tax bill.

How is Stamp Duty calculated?

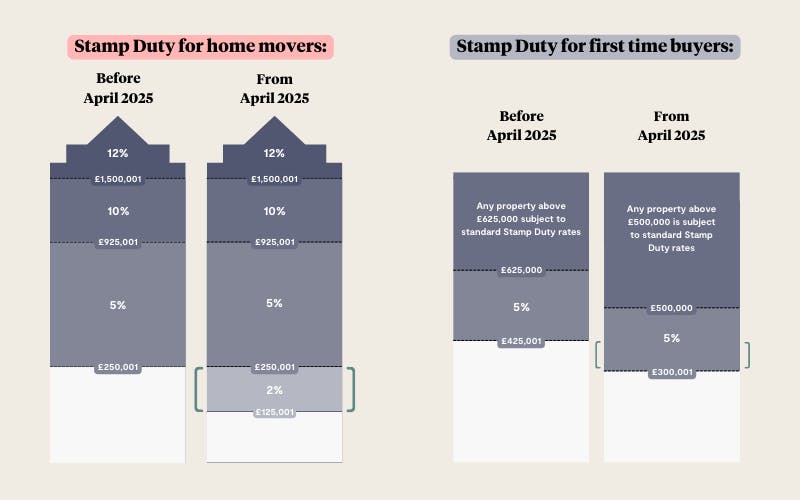

Stamp Duty Land Tax is calculated based on the property’s price and whether the buyer is buying their first home, moving house or purchasing a second property. A property investor would find themselves paying a higher rate than a home mover buying a property of the same price. From the 1st April 2025, how Stamp Duty is calculated is changing, pushing more people into the taxable range:

Do first time buyers pay Stamp Duty?

Yes, first-time buyers pay Stamp Duty, but only on properties that cost above £300,000. If you are purchasing a property that’s £300,000 or less, as a first-time buyer you won’t pay any Stamp Duty. If you’ve been a homeowner before but you sold the property to rent or live with family, you won’t qualify as a first-time buyer. This means that if you purchase a home, you'll pay Stamp Duty on any portion of the property's value over £125,000.

How much is Stamp Duty for first time buyers?

Whether or not you’ll pay Stamp Duty as a first-time buyer and the exact amount payable will depend on the price of the property you’re buying and its location. In England and Northern Ireland, if a property is £300,000 or less you won’t pay any Stamp Duty as a first time buyer. If you are purchasing a property worth more, you’ll pay no Stamp Duty on the first £300,000 of the property value, but 5% on anything between £300,0001 and up to £500,000. If you’re buying a property worth more than £500,000, the value over this won’t get any first-time buyer relief, which means you'll pay standard Stamp Duty rates for the remaining portion of the property price.

Wales

In Wales, Stamp Duty is known as land and buildings transaction tax and the first £225,000 of a property’s value is tax-free. After this, you will pay 5% on any share of the property over £225,000 and below £400,000. For any portion above £400,000 you will pay 7.5%, up to the value of £750,000.

Scotland

Scotland also has land and buildings transaction tax like Wales, but the first-time buyer threshold is less generous than the Welsh version. In Scotland there’s no tax payable on the first £175,000 of the property for first-time buyers, which will result in a reduction in the amount of tax payable up to £600.

What happens if I’m a first-time buyer buying with a homeowner?

If you are buying a home with someone who's already bought a home, you won’t qualify for first-time buyer Stamp Duty relief. In order to qualify for first-time buyer Stamp Duty relief, you both need to have never owned a property or been on property deeds for one before.

If you’re buying as a couple but are not married or in a civil partnership, you could buy the property solely in the first-time buyer’s name to qualify for the relief, but then your mortgage application will be based on one person’s salary, which could mean you can’t borrow as much.

When do you pay Stamp Duty?

If you’re buying a home in England or Northern Ireland, you’ll pay Stamp Duty within 14 days of completion. This is when all the contracts are signed, and you get the keys to your new home. If you’re using a solicitor, they’ll normally do any Stamp Duty-related admin for you and let you know when the payment needs to be made. However, many solicitors will want you to send them the money before the property purchase is complete to make this smoother.

Although solicitors will usually sort Stamp Duty out for you, it’s legally your responsibility to ensure it’s paid. Failure to pay on time could result in a fine and interest.

Can I get first time buyer Stamp Duty relief if I’m using a guarantor mortgage?

Yes, if you’re buying as a first-time buyer using a guarantor mortgage you’ll still be eligible for first-time buyer relief as long as your guarantor is only named on the mortgage, rather than the property.

To learn more about buying a house with help from family, take a look at our guarantor mortgages guide.

Can I get first time buyer Stamp Duty relief if buying a shared ownership property?

Yes, if you’re buying as a first-time buyer using shared ownership, you are eligible for first-time buyer stamp duty relief as long as you are buying through an approved shared ownership scheme.

Can I use my Lifetime ISA bonus to pay my Stamp Duty?

No, you cannot use your Lifetime ISA bonus to pay your stamp duty bill. Your LISA bonus must be used as part of the funds consolidated at the completion of the property transaction.

To learn more about the process of buying your first home, take a look at our buying a house timeline. This’ll walk you through the various steps involved so you have an idea what to expert.

If you’re feeling overwhelmed and have no idea where to start, talk to Tembo. We’ve helped hundreds of first-time buyers overcome common mortgage affordability obstacles such as a small deposit or modest salary. So if you’re worried your application will be rejected, our award-winning team can help. To get started, simply create a plan on our homebuyer platform to get a free, personalised recommendation. It only takes a few minutes, and there’s no credit check involved.

Need help accomodating higher Stamp Duty?

Create a free Tembo recommendation to see all the ways you could boost your mortgage affordability. We'll compare your eligibility to thousands of mortgage products and budget-boosting schemes, with no credit check!