Tembo Cash ISA rate changes to 4.55%

When it comes to saving for your future —whether it’s a first home, a holiday, a wedding or simply some financial protection for a rainy day — finding the right savings account can make all the difference.

As 2025, we're thrilled to introduce the new Tembo Cash ISA, offering a competitive 4.55% AER (variable) interest rate. This is the latest addition to our growing range of savings products, following the successful launch of our market-leading Lifetime ISA (LISA). With this new Cash ISA, your money isn’t just sitting in savings collecting dust - it’s actively working harder for you.

Open a Tembo Cash ISA with £10

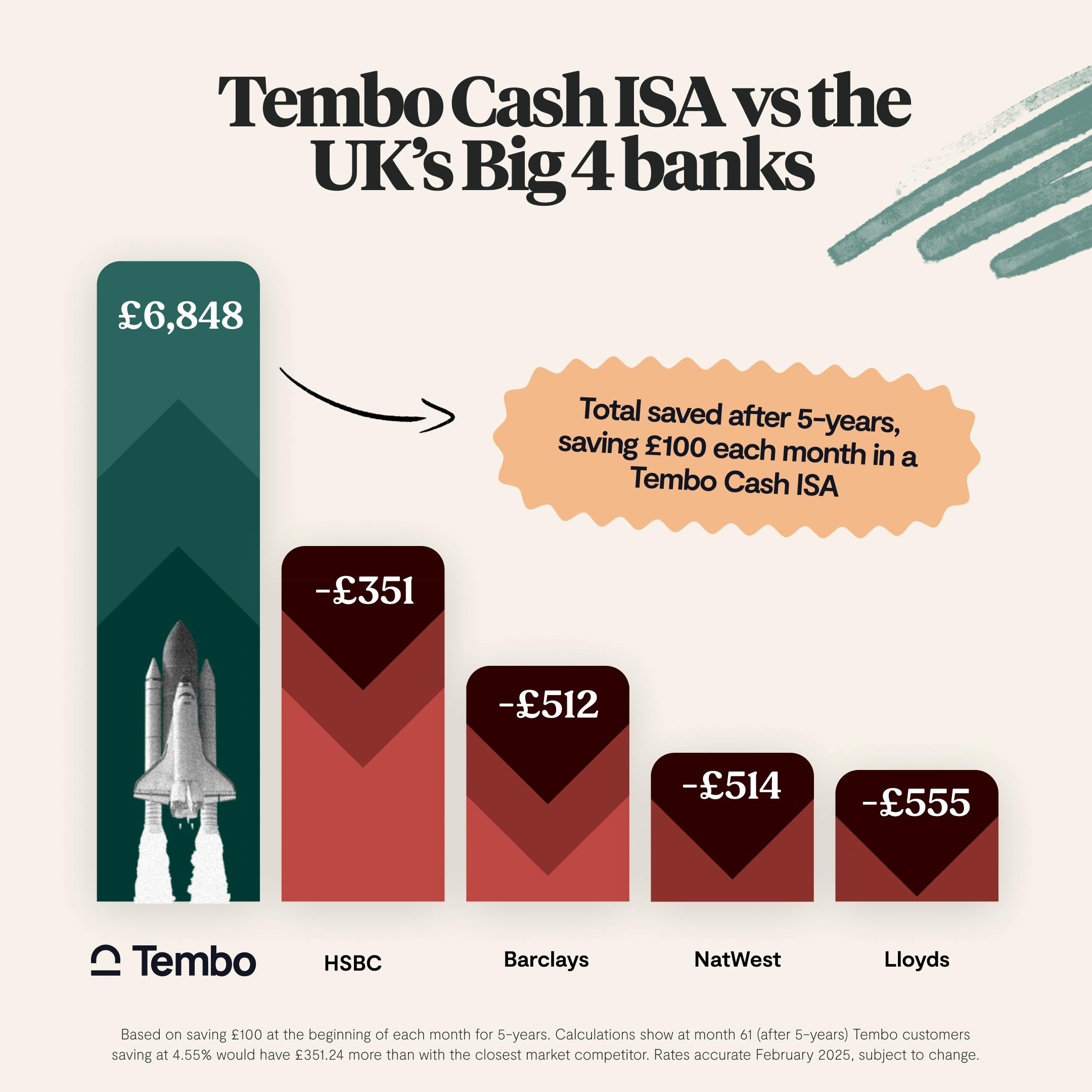

Start saving with a Tembo Cash ISA today and earn 4.55% AER (variable) on your savings. Over 5-years, that’s over £450 more than saving with one of the Big 4 banks.

What makes the Tembo Cash ISA so great?

When you’re saving for something important, the last thing you want is to settle for an account that won’t give you a good return. Unfortunately, that's exactly what many savers are doing. Research shows that 75% of savers still hold their savings with their main current account provider - despite the fact that high-street banks often offer significantly lower interest rates compared to providers like us.

The "Big Four" banks, for instance, currently provide an average interest rate of just 1.67% across their best easy-access Cash ISA accounts. Choosing one of these mainstream providers might feel convenient, but it’s likely costing you in the long run. With our competitive 4.55% AER (variable), you can earn over 2.7x more interest — giving your savings the boost they deserve.

To put it into perspective, if you save £100 per month over five years, with our 4.55% AER (variable) rate, your savings would grow by over £450 more in interest vs saving with one of the Big 4!

At Tembo, we believe we should make saving for your big life goals easier, not harder. That’s why with a Tembo Cash ISA you aren’t penalised for using your money or how long you save. Unlike other providers, your interest rate won’t drop after 12 months, if your balance falls below a certain amount or you make multiple withdrawals.

On the Tembo app you’ll find loads of ideas to help you save faster, as well as explainers on everything from investing to mortgages. You’ll also get access to tools designed to help you get mortgage-ready, not to mention rate trackers, webinars and more! As a Tembo saver, you’ll get access to our award-winning mortgage service fee-free when you're ready to buy or remortgage.

We’re rated ‘Excellent’ by over 1,800 savers

As rated by our customers on Trustpilot. From our intuitive savings app to our 10-minute customer response time, we pride ourselves on exceptional customer service end-to-end.

Who is Tembo?

Tembo is an award-winning digital savings & mortgage platform, helping thousands of savers build up their first house fund faster, or save towards other life milestones. Our new Cash ISA is the latest product in our growing savings range, following the launch of our market-leading Lifetime ISA (LISA) range in 2024.

Is Tembo a good Cash ISA?

As well as our competitive 4.55% AER (variable) interest rate, you can withdraw your funds from a Tembo Cash ISA whenever and as often as you’d like, with no impact on your interest rate. Plus, the interest rate doesn’t drop after 12 months or if your balance falls below a certain amount (unlike other providers). You’ll also accumulate interest daily, which is paid into your account every month.

What else do I get with Tembo?

With Tembo, you get way more than just an interest rate — as well as saving in our intuitive, award-winning saving app, you’ll get a stack of ideas and tools to help you save towards your goals faster. You’ll also get access to tools that are designed to get you mortgage-ready, rate trackers, webinars and more! Not to mention access to our friendly community, webinars and more! Plus, fee-free mortgage advice when you're ready to buy or remortgage through our award-winning mortgage service. 🚀

But our mortgage service isn’t standard - our team are specialists in helping people make home happen, often against the odds. On average, our customers increase their buying budget by £88,000! Not to mention you’ll also get your own dedicated mortgage team, free property insight reports to supercharge your property search, and access to our panel of experts including tried & tested conveyancers and surveyors. Get started here.

Is the Tembo Cash ISA paid monthly?

Your interest is accumulated daily and paid monthly into your Tembo Cash ISA. You can watch your interest grow daily in the app to see how your savings increase over time.

How long does it take to withdraw money from Tembo Cash ISA?

Withdraw funds from your Cash ISA whenever you need, and if you let us know by 2pm, you'll usually have the funds the same day, otherwise they'll land the next working day. And, unlike a Lifetime ISA, there are no withdrawal penalties to worry about.

Open a Tembo Cash ISA today

Save up to £20,000 each year tax-free and earn 4.55% AER (variable) on your savings. Enjoy unlimited instant withdrawals, plus no introductory rates, penalties or fees.

*Based on saving £100 at the beginning of each month for 5-years. Calculations show at month 61 (after 5-years) Tembo customers saving at 4.55% would have £483.35 on average more than saving with Barclays, HSBC, NatWest or Lloyds. Accurate February 2025.