How much tax do you pay on rental income?

Whether you’re an accidental landlord or a professional buy-to-let investor, paying tax on rental income is part and parcel of the job. But how much tax do you pay on rental income? And what can you offset and expense? In this guide we’ll explain how much tax you pay on rental income and how you could reduce your rental income tax bill while staying on the right side of HMRC.

What is rental income?

Rental income is made up of the money your tenants pay in rent, along with anything they pay you towards utility bills, repairs, cleaning fees for communal areas, and non-refundable deposits. If you keep a portion of their tenancy deposit when they move out of the property, this is classed as rental income too — even if you’re spending this money on repairs and maintenance.

Let’s imagine your tenants pay you £12,000 a year in rent. At the end of their tenancy, you keep £100 from their deposit to cover the cost of repairs and you keep an additional £50 for cleaning fees. This means your total rental income over the course of that year is £12,150.

Learn more: Can I change my mortgage to buy-to-let?

Do you pay tax on rental income?

Yes, you do pay tax on rental income. When completing your tax self assessment, not only will you need to include the amount of rent you charged over the last tax year, you’ll also need to declare how much your tenants paid you towards bills and repairs, along with any amounts kept from their deposits.

The good news is that many of these costs can be deducted as expenses, allowing you to reduce your taxable income and keep more money in your pocket.

Looking to remortgage an existing buy to let?

If you’re struggling to remortgage because you’re not earning enough in rental income to cover your buy-to-let mortgage repayments, a top slicing mortgage could be the answer. See if you’re eligible by creating a free Tembo plan.

What are allowable expenses for rental income?

When renting out a property, it’s important to keep track of your expenses. Here are some of the most common allowable expenses for rental income:

- Travel costs (to and from your rental property)

- Advertising and marketing costs

- Phone bills (in relation to your rental property)

- Cost of safety certificates

- Advisory fees e.g. legal and accountancy

- Subscription to property investment related magazines, products and services

If you own a residential rental property, you can also expense the following:

- Letting agents’ fees

- Legal fees for lets of a year or less, or for renewing a lease for less than 50 years

- Accountants’ fees

- Buildings and contents insurance

- Maintenance and repairs to the property (but not improvements)

- Utility bills, like gas, water and electricity

- Rent, ground rent, service charges

- Council Tax

- Services you pay for, like cleaning or gardening

- Other direct costs of letting the property, like phone calls, stationery and advertising

How much tax do you pay on rental income?

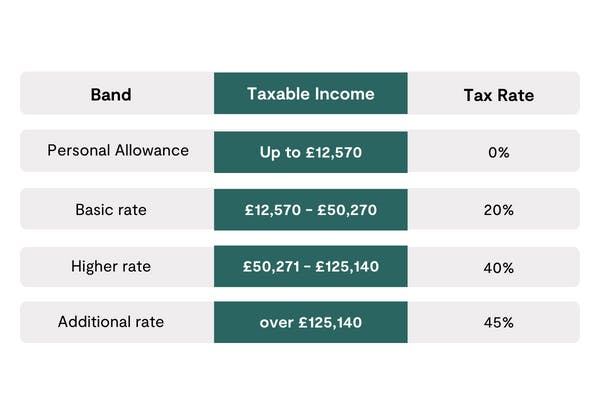

The amount of tax you’ll pay on rental income depends on your tax bracket and the amount you earn. Your rental profits will be taxed at the same rate as any income from your business and employment.

However, in some circumstances, your rental income could push you into a higher tax bracket. For example, let’s imagine you earn £40,000 from full-time employment and £12,000 in rental income during the same tax year. With a total income of £52,000, you’ll find yourself in the higher rate tax bracket of 40%.

Thankfully, you won’t be charged 40% on your total income. The first £12,570 of your total income will continue to be tax-free. Anything you earn between £12,571 and £50,270 will be taxed at 20% and only the amount above £50,271 will be taxed at 40%. Use our Take Home Pay Calculator to see what you could bring home each month after tax.

It may be possible to reduce your taxable income by claiming expenses. If you earn £52,000 from employment and rental income but you claim £3,000 in expenses, your taxable income will be £49,000, bringing you back into the basic rate tax band.

Learn more: How to get a buy-to-let mortgage

How much rental income is tax free in the UK?

The first £1,000 of your rental income is tax-free. This is known as your ‘property allowance’.

After this, you must file a Self Assessment tax return if your rental income is either:

- £2,500 to £9,999 after allowable expenses

- £10,000 or more before allowable expenses

If your rental income is between £1,000 and £2,500 a year, contact HMRC for more information. It may be possible to pay the tax via PAYE (if you’re employed), saving you the hassle of having to complete a Self Assessment tax return.

Can I deduct mortgage interest from rental income?

You can no longer deduct mortgage interest from rental income, following changes to the way that landlords are taxed. Under the previous system, landlords could reduce their tax bill by claiming mortgage interest as an expense - this all changed in April 2020. The new system offers landlords a tax credit based on 20% of their mortgage interest.

Unfortunately, some landlords are worse off under the new system, particularly those who are higher rate taxpayers and can no longer deduct mortgage interest at 40%.

Learn more: Is buy-to-let worth it in 2024?

How can I avoid paying tax on rental income?

You might not be able to avoid paying tax on rental income completely, but there are a number of ways to reduce your tax liability and keep more money in your pocket.

We’ve listed a couple of options below, but it’s always best to speak to a tax specialist to get expert advice.

1. Expense void periods

If your buy-to-let property is empty for any period of time, you can expense running costs such as energy bills and council tax.

2. Carrying forward your losses

If you’ve made significant rental losses in previous tax years but your buy-to-let property is now profitable, you may be able to lower your tax bill by carrying your previous losses forward.

3. Don’t forget your home office

It’s possible to claim expenses for the cost of running your home office, even if you only have one rental property. Home office costs can include electricity, broadband and home insurance, for example.

4. Buy your rental property with someone else

You may be able to reduce your tax bill by purchasing a buy-to-let property with a friend, family member or business partner and splitting the rental income between you.

This can be particularly effective for higher rate and additional rate taxpayers who’d like to help a child or grandchild invest in property.

Let’s imagine you earn £60,000 a year and you’d like to purchase a buy-to-let property.

If you buy the property alone, your rental income will be taxed at 40% (since you’re already a higher rate taxpayer).

If you buy the property alongside your daughter who earns £25,000 a year, her share of the rental income will be taxed at 20%. By reducing the amount of tax payable, your buy-to-let could be more profitable.

It’s up to you how you divide the rental income. It doesn’t need to be split 50/50 and it doesn’t need to reflect the amount you’ve each invested in the property. Dividing the rental income in favour of the lower tax payer tends to be more tax-efficient, as long as this income doesn’t push them into a higher tax bracket.

By the way: If you’d like to help a loved one get on the property ladder, we can help you find the right guarantor mortgages and first-time buyer schemes.

If you buy a rental property with your spouse or civil partner, you’ll usually have what’s known as a ‘joint tenancy’ or joint mortgage and the rental profits will automatically be split 50:50. If this isn’t a tax-efficient way of dividing your profits, contact HMRC to see if it’s possible to change the way your rental income is divided.

FAQs

Can you offset mortgage payments against rental income?

You can’t offset mortgage payments against rental income or claim your mortgage interest as an expense. However, as a landlord you’ll receive a tax credit worth 20% of your mortgage interest payments. So if your mortgage payments were £10,000 over the course of a year, you’d be eligible for £2,000 tax relief.

Does rental income count as earned income?

No, rental income doesn’t count as earned income — unless you’re renting out a furnished holiday home. If you’re the owner of a buy-to-let property, the income your property generates is classed as ‘unearned income’. While earned income is money you make from working, such as a salary, wages or tips, unearned income is money you receive without performing work, such as interest, dividends or rental income.

Do you pay national insurance on rental income?

You won’t usually need to pay National Insurance contributions on rental income, since it’s treated as ‘unearned’ income.

See what you could be offered

Whether you’re an existing landlord, or want to buy your first buy to let property. Create a free Tembo plan to get a personalised mortgage recommendation, including live rates and indicative monthly repayments.