Award-winning mortgage advice from the affordability experts

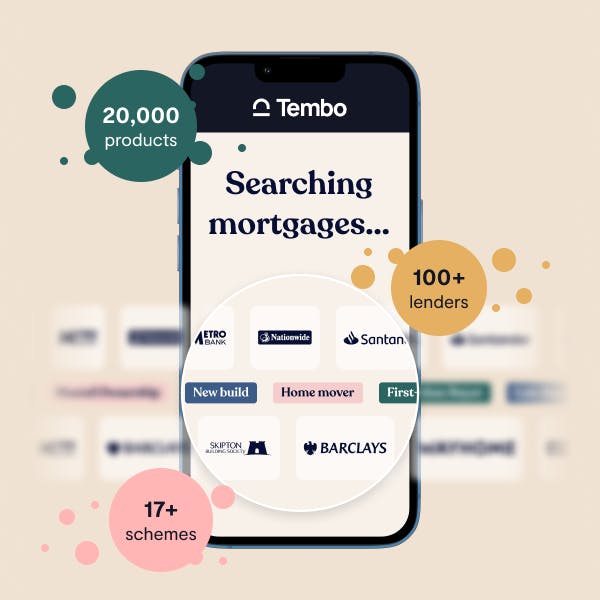

We've partnered with First Mortgage to help their customers that are failing "traditional" mortgage affordability to find the solution they need. How? Our smart technology assesses over 100 lenders and 17 specialist schemes - everything from guarantor mortgages to shared ownership - to increase buyer's budgets.

£82,000 average affordability boost

Voted the UK's Best Mortgage Broker

Available 7-days a week, plus evenings

Getting started with Tembo

Discover your true mortgage affordability & get your mortgage application underway in three simple steps.

Voted the UK's Best Mortgage Broker

We're on a mission to make home happen. That's why our customers voted us the UK's Best Mortgage Broker at the British Bank Awards 2022 and 2023. So whether you're struggling to buy your first home, it's time to upsize, or you need to remortgage in a hurry, talk to Tembo.

Tembo helped me to increase the affordability of my mortgage, allowing me to get the home of my dreams. They helped me get over multiple hurdles during the process, while being communicative throughout. I couldn't thank them enough.

Ali Mahmood